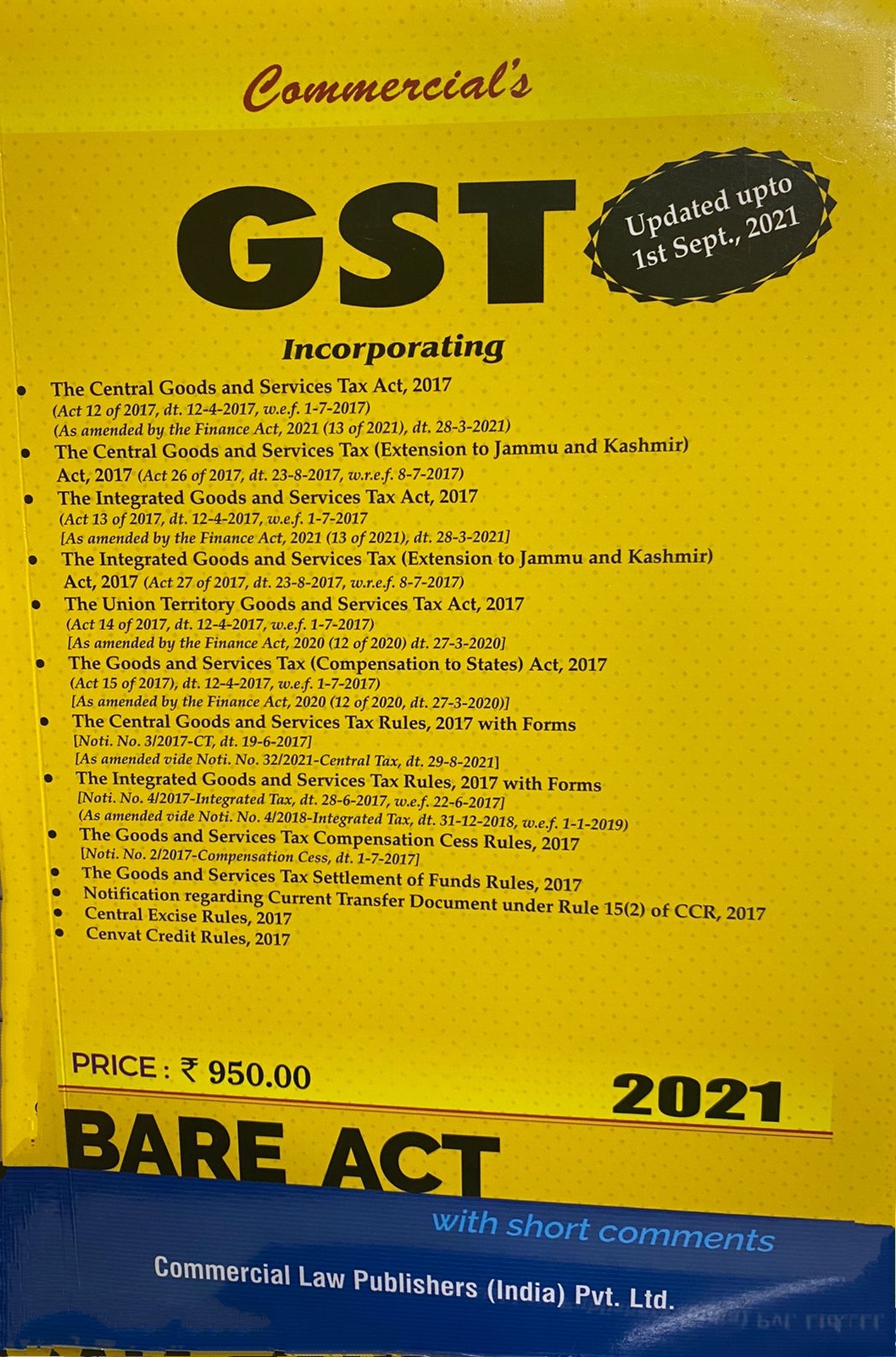

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021

₹950.00 Original price was: ₹950.00.₹620.00Current price is: ₹620.00.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Incorporating

- The Central Goods and Services Tax Act, 2017

(Act 12 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

(As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021) - The Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 26 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Integrated Goods and Services Tax Act, 2017

(Act 13 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017

[As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021] - The Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 27 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Union Territory Goods and Services Tax Act, 2017

(Act 14 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

lAs amended by the Finance Act, 2020 (12 of 2020) dt. 27-3-2020] - The Goods and Services Tax (Compensation to States) Act, 2017

(Act 15 of 2017), dt 12-4-2017, w.e.f. 1-7-2017)

[As amended by the Finance Act, 2020 (12 of 2020, dt. 27-3-2020)] - The Central Goods and Services Tax Rules, 2017 with Forms

- The Integrated Goods and Services Tax Rules, 2017 with Forms

[Noti. No. 4/2017-lntegrated Tax, dt. 28-6-2017, w.e.f. 22-6-2017] (As amended vide Noti. No. 4/2018-Integrated Tax, dt. 31-12-2018, w.e.f. 1-1-2019)

Noti. No. 3/2017-CT, dt. 19-6-2017] [As amended vide Noti. No. 2712021-Central Tax, dt. 1-6-2021, w.e.f. 1-6-2021] - The Goods and Services Tax Compensation Cess Rules, 2017

[Noti. No. 212017-Compensation Cess, dt. 1-7-2017] - The Goods and Services Tax Settlement of Funds Rules, 2017

- Notification regarding Current Transfer Document under Rule 15(2) of CCR, 2017

- Central Excise Rules, 2017

- Cenvat Credit Rules, 2017

Details :-

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Commercial

- Edition : SEPTEMBER, 2021

- ISBN-13 : 9789390926886

- ISBN-10 : 9789390926886

- Pages : 925 pages

- Language : English

- Binding : Paperback

Related

Related products

-

Add to cart

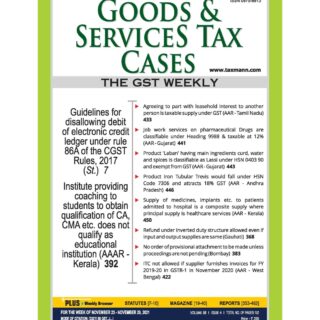

Taxmann’s GST Cases is a weekly in-print Journal that is delivered at your doorstep every week. This Journal is made for professionals, by the professionals, with a focus on the analysis of the latest statutory & judicial changes.

-

Add to cart

CA Madhukar N Hiregange, [B.Com., FCA, DISA, Passed CISA], is a senior partner at a multi-locational firm in India. He has jointly authored 23 books on Central Excise, Service Tax, Karnataka VAT and Excise/Service Tax Audit, IDT – IPCC Study Material, Central Sales Tax, GST – A Primer-2 Editions, GST Classification & Exemption 2017, Compendium of Issues and Solutions in GST – March 2018/ May 2019 and GST Tariff – October 2018. He is also working on Beginners Handbook on GST and 2 sectoral books on GST on Textiles/ Real Estate, slated to be published in November 2019. He is constantly active in spreading awareness about Indirect Taxes through seminars, articles, linkedin, facebook, youtube, caclubindia.com & hiregangeacademy.com, etc. He had been a Central Council Member, ICAI, for the term 2010-13 & 2106- 19, with a vision of enhancing the credibility of the profession and strengthening the professionals in practice and employment. He had also served as Chairman of the Indirect Tax Committee, for the year 2012 and term 2016-19, with the privilege of leading a wonderful and contributing team for 4 years.

-

Add to cart

Detailed and practical analysis of the GST provisions with case laws pertaining to the real estate industry.

Covering all possible dispute areas along with their resolutions.

Detailed analysis of the tax planning aspect. -

Reviews

There are no reviews yet.