Category: FINANCE ACT 2022

Showing 1–20 of 34 results

-

Add to cart

BDPS Customs Tariff with IGST and Foreign Trade Policy New HS 2022; Budget 2022-23 Highlights; Each item with Basic duty, Effective duty, IGST, AIDC, Social Welfare Surcharge, Total Duty and Foreign Trade Policy; Comprehensive Alphabetical Product Index (covering more than 18000 items); Export Policy; Duty Drawback Rates in each chapter; Anti Dumping Notifications; Safeguard Duty …

-

Add to cart

BDP’s Customs Tariff with IGST and New Import Policy (February 2022 Edition) (As on 1st February, 2022) – 50th (Golden Jubilee) Edition (in Three volumes) : 2022-2023 by Anand Garg.

-

Add to cart

Bharat Direct Taxes Ready Reckoner with Tax Planning by Mahendra B Gabhawala – 10th Edition 2022

Bharat’s Direct Taxes Ready Reckoner with Tax Planning by Mahendra B. Gabhawala – 10th Edition 2022 for A.Y. 2022-2023 and 2023-2024.

-

-

-

Add to cart

Bharat’s Direct Taxes Manual Set of 3 Vols By Ravi Puliani and Mahesh Puliani 30th Edition 2022

Bharats Direct Taxes Manual Set of 3 Vols By Ravi Puliani and Mahesh Puliani 30th Edition 2022

-

Add to cart

Bharat’s Income Tax Rules with Return Forms for A.Y. 2022-23 (In 2 Volumes) – 31st Edition 2022.

About Income Tax Rules with Return Forms for A.Y. 2022-23 (In 2 Volumes)

-

Add to cart

Bloomsbury’s GST Guide with Ready Reckoner – Covering assessment and appeal (2 Volumes) by Rakesh Garg – 6th Edition February 2022

-

Add to cart

Bloomsbury’s Guide to Understanding Financial Statements – Interpretation, Application and Analytics by B.D. Chatterjee – 1st Edition January 2022.

-

Add to cart

Bloomsbury’s The Comprehensive GST Tariff by Puneet Agrawal – 1st Edition February 2022.

-

Add to cart

Centax’s Customs Law Manual 2022-23 (Set of 2 Volume) by R.K. Jain – 66th Edition 2022-23. This book provides the complete text of the Customs and Allied Laws with a Commentary on Customs Law & Procedure. It exhaustively covers the amended & up to date Acts, Rules, Regulations, Notifications, Forms, Allied Laws, SEZ, Circulars, Public Notices, and Clarifications.

-

Add to cart

Centax’s Customs Tariff of India 2022-23 (Set of 2 Volumes) by R.K. Jain – 74th Edition February 2022. This book provides the complete text of the rate of duties as applicable on import and export of goods with amended tariff schedules as applicable from 1-1-2022. It includes Customs Duty Rates & Exemptions, IGST, Export Tariff, Cesses, Anti-dumping, Safeguard, Additional Duties & Commodity Index.

-

Add to cart

Centax’s GST Law Manual 2022-23 by R.K. Jain (2 Volumes) – 15th Edition 2022-2023. This book provides the complete, updated, amended & annotated text of all provisions of the GST Law, including Acts, Rules, Forms with Ready Reckoner & 1,000 Tips along with SGST, Circulars, Notifications & Advance Rulings.

-

Add to cart

Commercial’s Direct Taxes Ready Reckoner with Tax Planning by Girish Ahuja & Ravi Gupta – 23rd Edition 2022 for A.Y. 2022-2023 and 2023-2024.

-

Add to cart

Commercial Handbook on Direct Taxes for Assessment Year 2022-23 and 2023-24 by G Sekar – 21st Edition 2022

-

-

Add to cart

Commercial Income Tax Rules By Dr Girish Ahuja & Dr Ravi Gupta – 11th Edition 2022 Commercial Income Tax Rules By Dr Girish Ahuja & Dr Ravi Gupta – 11th Edition 2022 Key Features : Updated Income Tax Rules till date Comprehensive Compliance Guidelines Relevant Allied Rules and Schemes Contains Latest IT Forms Companion Volume …

-

Add to cart

Commercial Personal Income Tax for Financial Year 2022-23 by G Sekar – 17th Edition 2022

Commercial Personal Income Tax for Financial Year 2022-23 by G Sekar – 17th Edition 2022

-

Add to cart

Commercial’s Practical guide on TDS and TCS (Financial Year 2022-23) by G Sekar – 21st Edition 2022

-

Add to cart

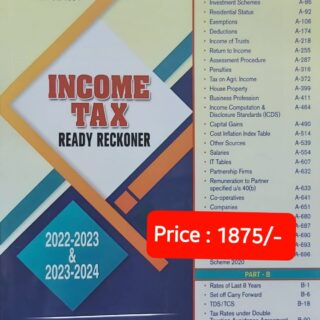

Garg Income Tax Ready Reckoner for Assessment Year 2022-2023 & 2023-2024

LMH Publications Garg’s Income Tax Ready Reckoner for Assessment Year 2022-2023 & 2023-2024.