Category: Featured Product Collection

Showing 1–20 of 1004 results

-

Add to cart

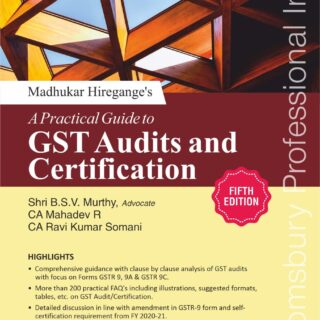

The fifth edition of this book has been written with a perspective to enable the taxpayers to ensure compliance with the applicable provisions of GST related to filing of annual returns and self-certified Form GSTR-9C.

-

Add to cart

Law as amended by the Finance Act,2021 & Taxation and Other Laws(Relaxation and Amendment of Certain Provisions) Act, 2020 applicable for Assessment Year 2022-23

-

Add to cartThe book incorporates the following :

- Income Tax

- International Taxation

- Guideline Answers

- Landmark Judgments

- 300 Illustrations arranged Topic-wise/Section-wise

-

Add to cart

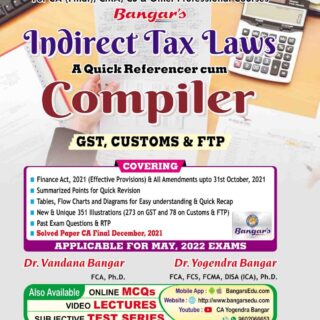

Aadhya Prakashan CA Final Indirect Tax Laws GST Customs

Aadhya Prakashan CA Final Indirect Tax Laws GST Customs & FTP A Quick Referencer Cum Compiler New Syllabus By Dr Yogendra Bangar and Dr Vandana Bangar Applicabe for May 2022 Exam

-

Add to cart

Aadhya PrakashanComprehensive Guide to Indirect Tax Laws by Yogendra Bangar for May 2022 Exam

-

Add to cart

Aadhya Prakashan Comprehensive Guide to Taxation (Part-I Income Tax) by Yogendra Bangar for May 2022 Exam

-

Add to cart

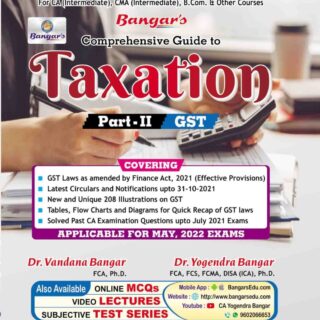

Aadhya Comprehensive Guide to Taxation (Part-II GST) (CA Inter) – (New & Old Syllabus) by Dr. Yogendra Bangar, Vandana Bangar for May 2022 Exam – 19th Edition December 2021.

-

Add to cart

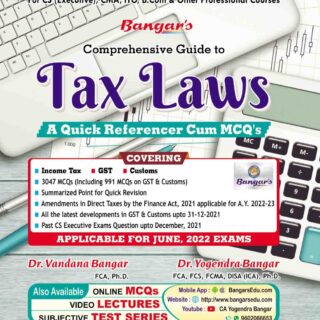

The distinguishing features of this book are

- Income Tax GST Customs

- International Taxation. Tax Planning & Tax Management

- 3047 MCQ’s (Including 991 MCQ’s on GST & Customs)

- Summarized Point for Quick Revision

-

Add to cart

Amendments in Direct Taxes by the Finance Act, 2021 & Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020

-

Add to cart

AJ Publication’s A Simplified Approach to Company Law (CS-Executive) (New Course) by Anoop Jain for June 2022 Exams – 18th Revised Edition 2022.

-

Add to cart

AJ Publication Corporate Funding & Listings in Stock Exchanges (CS-Professional) (New Syllabus) by Anoop Jain for June 2022 Exams – 7th Revised Edition 2022

-

Add to cart

AJ Publication’s Corporate Restructuring, Insolvency, Liquidation & Winding-up (CS-Professional) (New Syllabus) by Anoop Jain for June 2022 Exams – 18th Revised Edition 2022

-

Add to cart

AJ Publication’s Drafting, Pleadings & Appearance (CS-Professional) (New Syllabus) by Anoop Jain for June 2022 Exams – 18th Revised Edition 2022

-

Add to cart

AJ Publication’s Jurisprudence, Interpretation & General Law (CS-Executive) (New Syllabus) by Anoop Jain for June 2022 Exams – 8th Revised Edition 2022.

-

Add to cart

AJ Publication’s Resolution of Corporate Disputes Non Compliances and Remedies (CS-Professional) (New Syllabus) by Anoop Jain for June 2022 Exams – 7th Revised Edition 2022

-

Add to cart

AJ Publication’s Secretarial Audit, Compliance Management and Due Diligence (CS-Professional) (New Syllabus) by Anoop Jain for June 2022 Exams – 18th Revised Edition 2022.

-

Add to cart

AJ Publication Securities Laws & Capital Markets (CS-Executive) (New Course) by Anoop Jain for June 2022 Exams – 18th Revised Edition 2022

-

Add to cart

AJ Publication’s Setting up of Business Entities and Closure (CS-Executive) (New Course) by Anoop Jain for June 2022 Exams – 8th Revised Edition 2022

-

Add to cart

Contents Part – I Company Law, Principles & Concepts 1 Basics of company 2 E-governance 3 Membership 4 Register and returns 5 Share Capital Part-A (Basics) 6 Share Capital Part – B (Prospectus) 7 Share Capital Part – C (issue of shares) 8 Share Capital Part – D (allotment of share) 9 Share capital part-E …