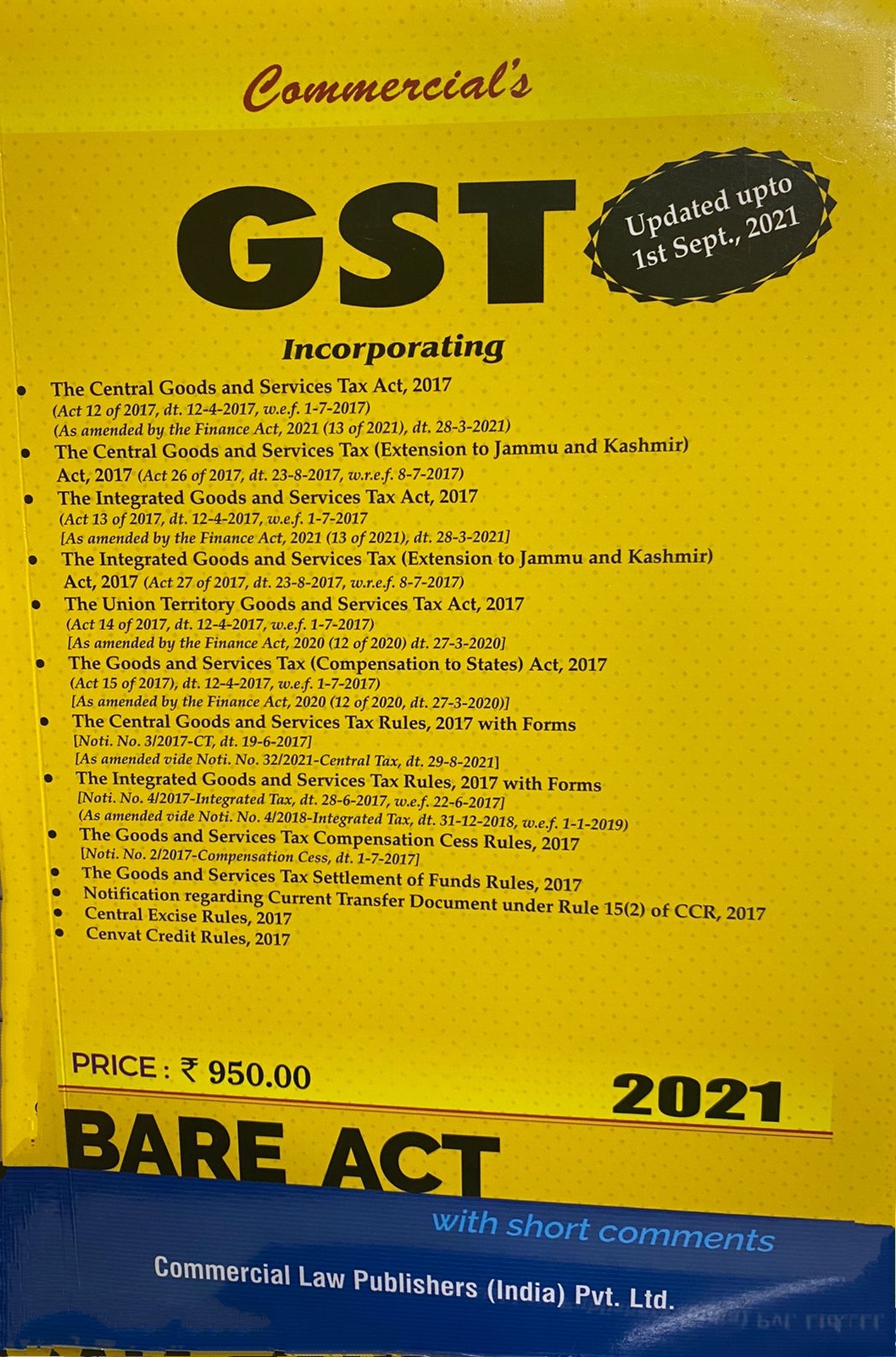

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021

₹950.00 Original price was: ₹950.00.₹620.00Current price is: ₹620.00.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Incorporating

- The Central Goods and Services Tax Act, 2017

(Act 12 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

(As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021) - The Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 26 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Integrated Goods and Services Tax Act, 2017

(Act 13 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017

[As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021] - The Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 27 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Union Territory Goods and Services Tax Act, 2017

(Act 14 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

lAs amended by the Finance Act, 2020 (12 of 2020) dt. 27-3-2020] - The Goods and Services Tax (Compensation to States) Act, 2017

(Act 15 of 2017), dt 12-4-2017, w.e.f. 1-7-2017)

[As amended by the Finance Act, 2020 (12 of 2020, dt. 27-3-2020)] - The Central Goods and Services Tax Rules, 2017 with Forms

- The Integrated Goods and Services Tax Rules, 2017 with Forms

[Noti. No. 4/2017-lntegrated Tax, dt. 28-6-2017, w.e.f. 22-6-2017] (As amended vide Noti. No. 4/2018-Integrated Tax, dt. 31-12-2018, w.e.f. 1-1-2019)

Noti. No. 3/2017-CT, dt. 19-6-2017] [As amended vide Noti. No. 2712021-Central Tax, dt. 1-6-2021, w.e.f. 1-6-2021] - The Goods and Services Tax Compensation Cess Rules, 2017

[Noti. No. 212017-Compensation Cess, dt. 1-7-2017] - The Goods and Services Tax Settlement of Funds Rules, 2017

- Notification regarding Current Transfer Document under Rule 15(2) of CCR, 2017

- Central Excise Rules, 2017

- Cenvat Credit Rules, 2017

Details :-

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Commercial

- Edition : SEPTEMBER, 2021

- ISBN-13 : 9789390926886

- ISBN-10 : 9789390926886

- Pages : 925 pages

- Language : English

- Binding : Paperback

Related

Related products

-

-

Read more

Universal’s Guide to CLAT & LL.B. Examination is a comprehensive work catering to the need of candidates appearing for law entrance examinations conducted by law universities. It provides multiple choice questions and exhaustive theory on every subject forming the part of the syllabus of the examination. It also contains questions that have been asked in the previous year examinations as well as other multiple-choice questions. It is an indispensable guide for law entrance examination aspirants.

-

Read more

Taxmann’s Securities and Exchange Board of India (SEBI) Manual is a compendium of Amended, Updated & Annotated text of Acts/Rules/Regulations/Circulars/Master Circulars, etc. on SEBI & Securities Laws. This book covers the following Laws

Reviews

There are no reviews yet.