Shop

Showing 81–100 of 1357 results

-

Add to cart

Bestword CA Final A Textbook on Corporate And Economic Laws New Syllabus By CA Munish Bhandari Applicable for May 2022 Exam

-

Add to cart

Bestword CA Final Combo Law (Textbook+Handbook) New Syllabus By Munish Bhandari Applicable for May 2022 Exam

-

Add to cart

This Book is updated upto 31st October, 2021 and is meant for May, 2022 Exams (New Syllabus).

-

-

Add to cart

All important key words are highlighted in red in this book in maximum topics so as to enable students to remember and write in exams

-

Add to cart

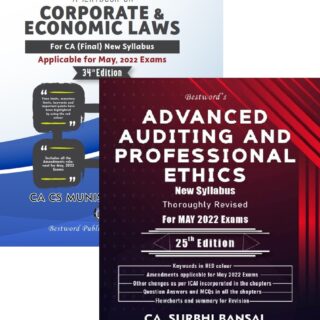

This Edition includes all the relevant Amendments, Rules, Regulations, Notifications and Circulars relevant for May 2022 Exams (New Syllabus).

-

Add to cart

This Book is updated upto 31st October, 2021 and is meant for May, 2022 Exams (New Syllabus).

-

Read more

This book has been specially designed for the students appearing in CA (Final) Examination of ICAI. It has been written in accordance with the Syllabus prescribed by ICAI for Paper 4: Corporate and Economic Laws (New Syllabus). All such topics / sections as have been excluded vide ICAI’s Announcements dated 24th June 2019, 22nd July 2019, 15th July 2020 and …

-

Read more

Bestword’s A Handbook on Corporate and Other Laws (CA Intermediate) – (New Syllabus) by CA CS Munish Bhandari for Nov 2021 Exam – 26th Edition August 2021.

-

Read more

Use of easy and lucid language, To-The-Point but comprehensive discussion and Student Friendly Approach would make the study of law simple, easy and interesting. Relevant background behind the legal provisions has been incorporated at relevant places. This would enable the students to understand the rationale behind the complicated legal provisions, create an interest in the subject and understand …

-

Read more

Incorporates all the changes made in Syllabus as per various Announcements made by ICAI. CODE OF ETHICS, 2020, STATEMENT ON PEER REVIEW (REVISED 2020), CARO, 2020, Changes in Quality review, changes made in Form 3CD in October 2020, Changes made by Companies (Amendment) Act,2020 have been included alongwith relevant updates in the chapters. Accordingly, this Edition has been strictly designed as per ICAI’s latest Study material applicable for 2021 exams. Use of easy and lucid language, To-The-Point but comprehensive discussion and Student Friendly Approach would make the study simple, easy and interesting. Tabular and Graphic presentation, point-wise discussion, use of headings and simplified language would facilitate easy understanding and learning. More than 1500 MCQs (as per new exam pattern) have been included in this Edition. Flowcharts on various topics (including Standards on Auditing) would help the students in building strong conceptual clarity and quick revision. The detailed discussion and inter-linking of topics would be helpful in building strong conceptual clarity. Point-wise answers would facilitate easy and quick understanding and revision. Includes questions asked in past CA (Final) Examinations including July, 2021 Question Paper. Incorporates a number of case studies and past attempt questions with detailed and hint answers. Important keywords in most of the topics have been highlighted in Red …

-

Read more

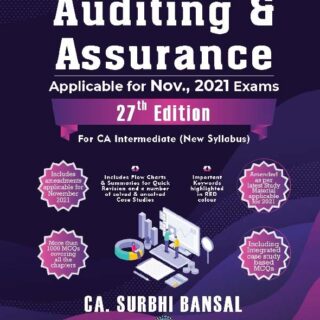

ALL RECENT ANNOUNCEMENTS OF ICAI INCORPORATED WITHIN THE CHAPTERS. Specially designed Book for the students appearing in CA (Intermediate) (New Syllabus) Examinations of ICAI. Written in accordance with the latest syllabus and new pattern of examination including Multiple Choice Questions (MCQs) prescribed by ICAI. A large number of MCQs covering all the chapters. Inclusion of …

-

Add to cart

Bestword’s Auditing And Assurance (New Syllabus) By Surbhi Bansal For November 2021 Exam

ALL RECENT ANNOUNCEMENTS OF ICAI INCORPORATED WITHIN THE CHAPTERS.

- Specially designed Book for the students appearing in CA (Intermediate) (New Syllabus) Examinations of ICAI.

- Written in accordance with the latest syllabus and new pattern of examination including Multiple Choice Questions (MCQs) prescribed by ICAI.

-

Add to cart

Bestword’s MCQs On Corporate And Allied Laws And Economic Laws By Munish Bhandari For Nov 2021 Exam

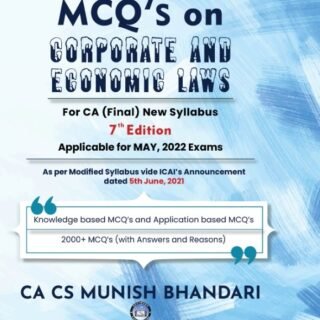

Contains more than 2,000 MCQs (with Answers and Reasons).

- Includes ‘Knowledge-based MCQs’ requiring ‘knowledge and comprehension’ and ‘Application-based MCQs’ requiring ‘application and analysis’ as per the pattern of Exam suggested by ICAI.

- Includes case study based MCQs requiring application of concepts.

- Includes 2 Mock Test Papers containing MCQs of 30 Marks in each Paper.

-

Add to cart

Contains more than 2,000 MCQs (with Answers and Reasons). Includes ‘Knowledge-based MCQs’ requiring ‘knowledge and comprehension’ and ‘Application-based MCQs’ requiring ‘application and analysis’ as per the pattern of Exam suggested by ICAI. Includes case study based MCQs requiring application of concepts. Includes 2 Mock Test Papers containing MCQs of 30 Marks in each Paper. The MCQs (Questions as well as Options) have been amended …

-

Add to cart

Better Drafting – Economical Edition With Civil & Criminal (Hardbound In Diglot By Justice B.K. Behera) (Hardbound, Hindi, Justice B.K. Behera) Specifications Book Better Drafting – Economical Edition With Civil & Criminal (Hardbound In Diglot By Justice B.K. Behera) Author Justice B.K. Behera Binding Hardbound Publishing Date 2020 Publisher Vinod Publication Pvt. Ltd. Edition 1th Number …

-

Add to cart

GST Acts CGST Act, 2017 Introduction to GST Chapter 1 Preliminary1-2 Chapter 2 Administration Chapter 3 Levy and collection of tax Chapter 4 Time and value of supply Chapter 5 Input tax Credit Chapter 6 Registration Chapter 7 Tax Invoice, debit/credit note Chapter 8 Accounts and Records Chapter 9 Returns Chapter 10 Payment of Tax …

-

Add to cart

CA. Durgesh Singh has overall 14 years teaching experience at CA Final in Direct & Indirect Taxes. He is immensely popular with students for his teaching ski lls on the subject. With a big four background, he is currently a Partner in a large CA Firm with an expertise in Corporate, International and Indirect Taxation matters. He believes in the mantra that “if you know why, you know how”. He is known for conceptual teaching along with problem solving in class for better presentation of answers in exams. At the same time he summarises the entire subject through charts for last day revision and preparing for the exam day through mock tests. His students have been All India Rank holders and best paper awardees in Direct and Indirect Taxes. His students are preferred in Big Four as his teaching is more contemporary, suited to the present dynamic scenario. He is the only faculty in India of repute to teach Direct as well as Indirect Taxation at CA Final & I PCC level

-

Add to cart

BHARAT CA INTER COST AND MANAGEMENT ACCOUNTING NEW SYLLABUS BY SUNIL KESWANI APPLICABLE FOR MAY/NOVEMBER 2022 EXAM 9789390854387

-

Add to cart

Bharat Companies (Auditors Report) Order By CA Kamal Garg GST Law and Commentary Analysis and Procedures By Bimal Jain & A2Z Taxcorp LLP Description About The Book This GST book extensively covers in-depth analyses of CGST, SGST, IGST, UTGST and GST Compensation Cess Laws along with the Rules, Notifications, Circulars, Instructions and Clarifications issued …