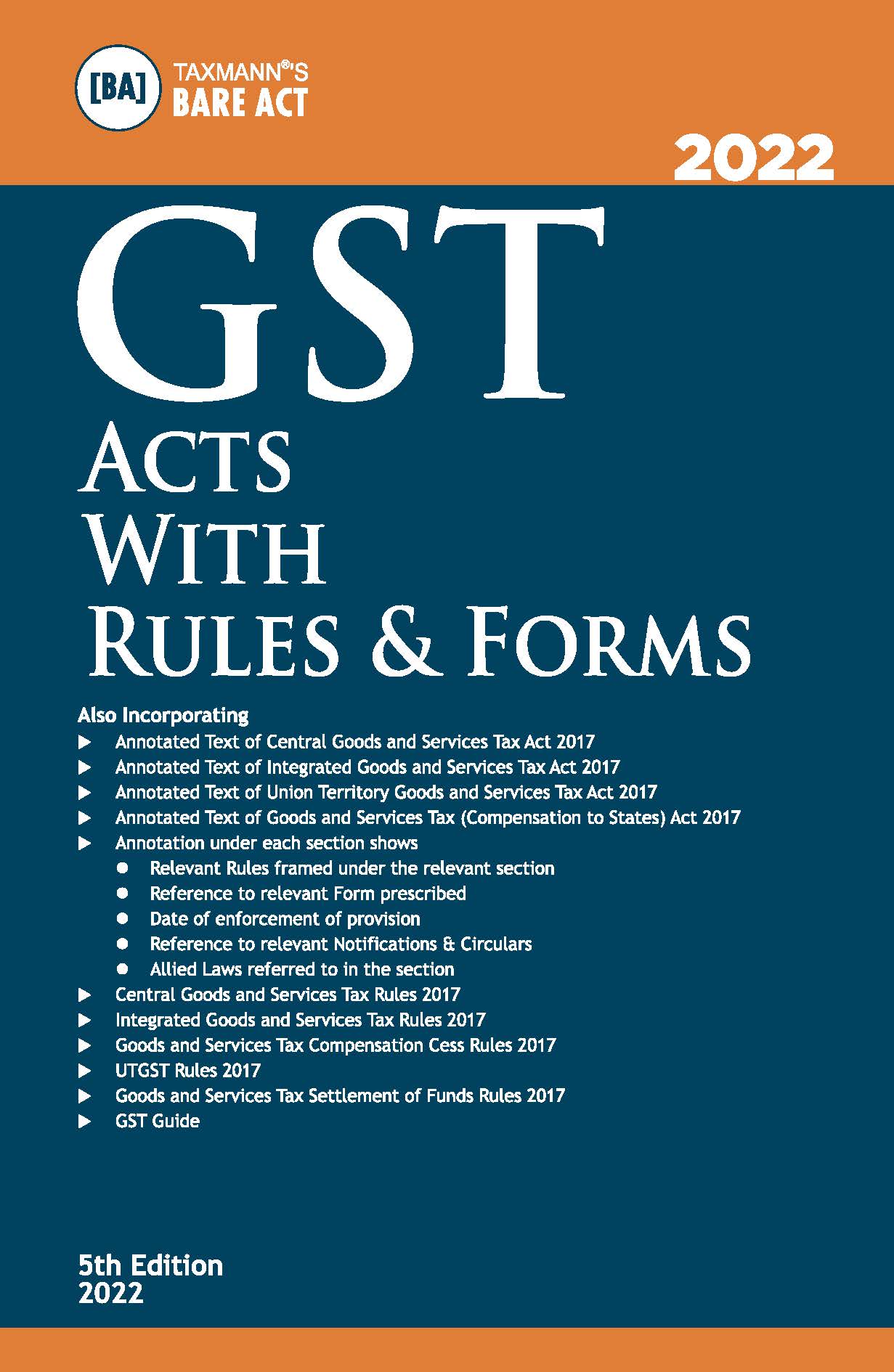

Taxmann GST Acts with Rules & Forms (Bare Act) – 5th Edition 2022

₹950.00 Original price was: ₹950.00.₹645.00Current price is: ₹645.00.

Taxmann’s GST Acts with Rules & Forms (Bare Act) As Amended by Finance Act 2021 (Updated till 15-12-2021) – 5th Edition December 2021. Covering Amended, Updated & Annotated text of the CGST/IGST/UTGST Acts & Rules, etc. along with Reference to Relevant Forms (with Action Points), Date of Enforcement of Provisions, Notifications & Circulars, Allied Laws [updated till 15th December 2021 & amended by the Finance Act 2021]. What sets it apart is the presentation of the GST Act(s), along with Relevant Rules and Reference to Relevant Forms, Notifications, etc. The readers also get a specially curated Guide to GST along with the above.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Taxmann’s GST Acts with Rules & Forms contains Amended, Updated & Annotated text of the following GST Act(s) & Rules [updated till 15th December 2021 & amended by the Finance Act 2021]:

- Central Goods & Services Tax Act & Rules

- Integrated Goods & Services Tax Act & Rules

- Union Territories Goods & Services Tax Act & Rules

- GST (Compensation to States) Act & Goods & Services Tax Compensation Cess Rules

- Goods and Services Tax Settlement of Funds Rules

What sets it apart is the presentation of the GST Acts, along with Relevant Rules & Reference to Relevant Forms, Notifications etc. In other words, the Annotation under each Section shows:

- Relevant Rules framed under the relevant Section

- Reference to Relevant Forms prescribed

- Reference to Relevant Notifications & Circulars

- Date of enforcement of provisions

- Allied Laws referred to in the Section

The readers also get a specially curated GST Guide along with the above.

The Present Publication is the 5th Edition, authored by Taxmann’s Editorial Board, updated till 15th December 2021 & amended by the Finance Act 2021, with the following noteworthy features:

- [Taxmann’s series of Bestseller Books] on GST Laws

- [Follows the Six-Sigma Approach] to achieve the benchmark of ‘zero error.’

The contents of the book are as follows:

- Specially curated Guide to GST Laws

- Amended, Updated & Annotated Text [along-with Subject Index] of the following:

- Central Goods & Service Tax Act, 2017 [including CGST (Removal of Difficulties) Orders & Text of provisions of Allied Acts referred to in CGST Act]

- Integrated Goods & Service Tax Act, 2017

- Union Territories Goods & Service Tax Act, 2017

- Goods & Services (Compensation to States) Act, 2017

- GST Rules of Forms

- Central Goods & Service Tax Rules, 2017

- Integrated Goods & Service Tax Rules, 2017

- Goods and Services Tax Compensation Cess Rules, 2017

- Union Territories Goods & Service Tax Rules, 2017

- Union Territory Goods and Services Tax (Andaman and Nicobar Islands) Rules, 2017

- Union Territory Goods and Services Tax (Chandigarh) Rules, 2017

- Union Territory Goods and Services Tax (Dadra and Nagar Haveli) Rules, 2017

- Union Territory Goods and Services Tax (Daman and Diu) Rules, 2017

- Union Territory Goods and Services Tax (Lakshadweep) Rules, 2017

- Goods and Services Tax Settlement of Funds Rules, 2017

- Goods and Services Tax Appellate Tribunal (Appointment and Conditions of Service of President and Members) Rules, 2019

- National Anti-Profiteering Authority: Procedure and Methodology

- Tribunal Reforms Act, 2021

- Conditions of Service of Chairperson and Members of Tribunals, Appellate Tribunals and other Authorities

- Tribunal (Conditions of Service) Rules, 2021

Details

- Binding : Paperback

- Publisher : Taxmann

- Author : Taxmann

- Edition : 5th Edition 2022

- Language : English

- ISBN-10 : 9789392211393

- ISBN-13 : 9789392211393

Related

Related products

-

Add to cart

GST Annual Return & Reconciliation covers comprehensive analysis in the form of Case Studies, Advanced FAQs, Step-by-Step Guides etc., on Forms 9, 9A & 9C, along with issues relating to Anti-profiteering & policy mismatch in GST & Accounting Standards. This book will be helpful for GST Professionals engagement in advisory, compliance, and litigation services.

-

Add to cart

Taxmann’s GST Tariff with GST Rate Reckoner (Set of 2 Volumes) – 16th Edition February 2022. This book provides GST Tariff for Goods and Services with amended tariff schedule as applicable from 1-1-2022. It provides HSN-wise and SAC-wise Tariff of all the Goods and Services along with GST Tariff Notifications (rate of tax & exemptions), Latest Clarifications, Case Laws and Explanatory Notes.

-

Add to cart

Centax’s GST Law Manual 2022-23 by R.K. Jain (2 Volumes) – 15th Edition 2022-2023. This book provides the complete, updated, amended & annotated text of all provisions of the GST Law, including Acts, Rules, Forms with Ready Reckoner & 1,000 Tips along with SGST, Circulars, Notifications & Advance Rulings.

-

Add to cart

Chapter 1 GST in India — An Overview Chapter 2 Assessment, Adjudication Demand and Recovery: Legal Framework Chapter 3 Legal Terminology and Principles of Interpretation Chapter 4 Assessment under GST Chapter 5 Adjudication of Demand Chapter 6 Demand and Recovery Chapter 7 Liability to Pay Tax in Certain Cases Chapter 8 Miscellaneous Provisions Applicable to Assessment etc. Appendix 1 Meaning of Important Legal Maxims …

Reviews

There are no reviews yet.