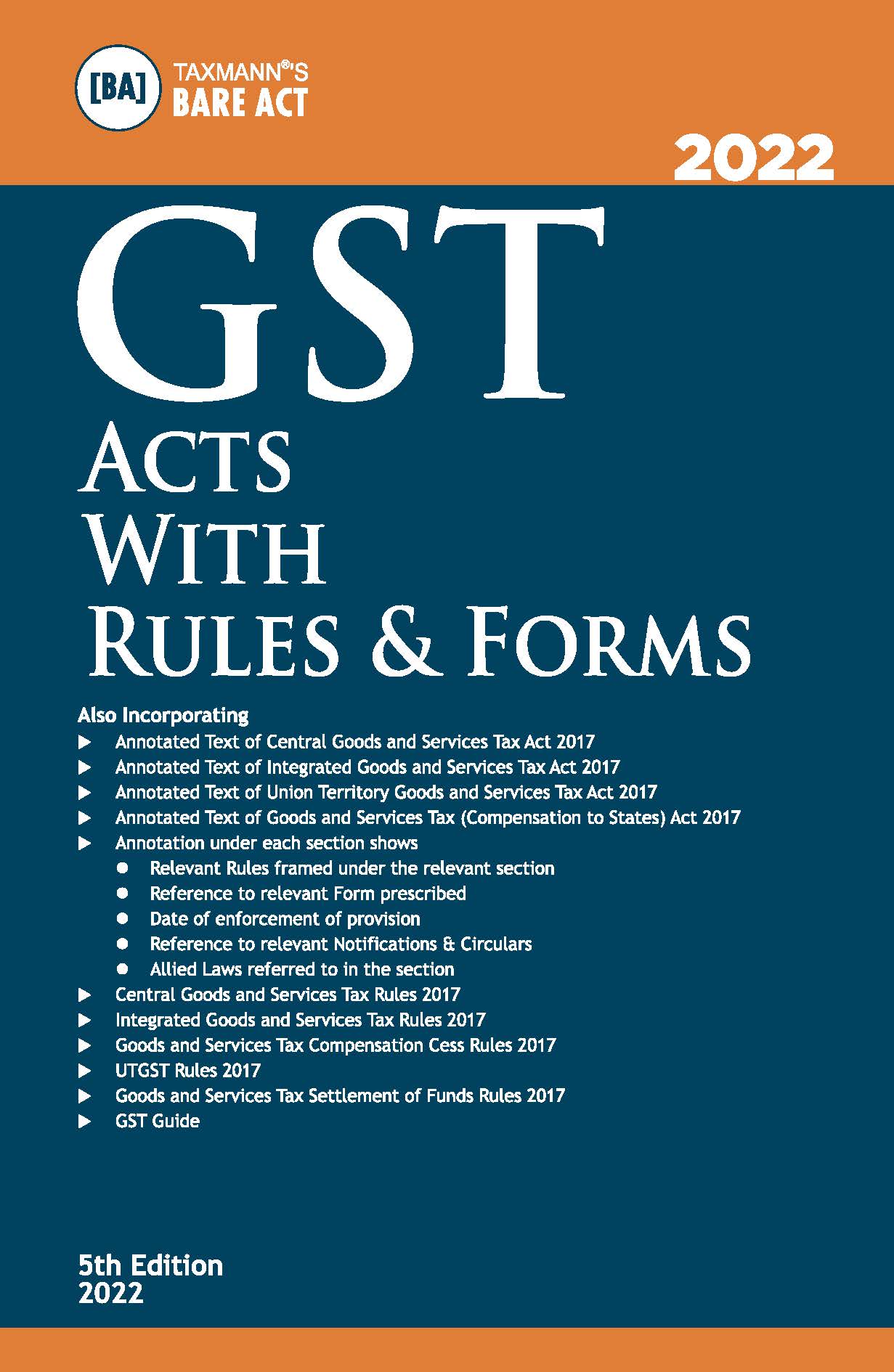

Taxmann GST Acts with Rules & Forms (Bare Act) – 5th Edition 2022

₹950.00 Original price was: ₹950.00.₹645.00Current price is: ₹645.00.

Taxmann’s GST Acts with Rules & Forms (Bare Act) As Amended by Finance Act 2021 (Updated till 15-12-2021) – 5th Edition December 2021. Covering Amended, Updated & Annotated text of the CGST/IGST/UTGST Acts & Rules, etc. along with Reference to Relevant Forms (with Action Points), Date of Enforcement of Provisions, Notifications & Circulars, Allied Laws [updated till 15th December 2021 & amended by the Finance Act 2021]. What sets it apart is the presentation of the GST Act(s), along with Relevant Rules and Reference to Relevant Forms, Notifications, etc. The readers also get a specially curated Guide to GST along with the above.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Taxmann’s GST Acts with Rules & Forms contains Amended, Updated & Annotated text of the following GST Act(s) & Rules [updated till 15th December 2021 & amended by the Finance Act 2021]:

- Central Goods & Services Tax Act & Rules

- Integrated Goods & Services Tax Act & Rules

- Union Territories Goods & Services Tax Act & Rules

- GST (Compensation to States) Act & Goods & Services Tax Compensation Cess Rules

- Goods and Services Tax Settlement of Funds Rules

What sets it apart is the presentation of the GST Acts, along with Relevant Rules & Reference to Relevant Forms, Notifications etc. In other words, the Annotation under each Section shows:

- Relevant Rules framed under the relevant Section

- Reference to Relevant Forms prescribed

- Reference to Relevant Notifications & Circulars

- Date of enforcement of provisions

- Allied Laws referred to in the Section

The readers also get a specially curated GST Guide along with the above.

The Present Publication is the 5th Edition, authored by Taxmann’s Editorial Board, updated till 15th December 2021 & amended by the Finance Act 2021, with the following noteworthy features:

- [Taxmann’s series of Bestseller Books] on GST Laws

- [Follows the Six-Sigma Approach] to achieve the benchmark of ‘zero error.’

The contents of the book are as follows:

- Specially curated Guide to GST Laws

- Amended, Updated & Annotated Text [along-with Subject Index] of the following:

- Central Goods & Service Tax Act, 2017 [including CGST (Removal of Difficulties) Orders & Text of provisions of Allied Acts referred to in CGST Act]

- Integrated Goods & Service Tax Act, 2017

- Union Territories Goods & Service Tax Act, 2017

- Goods & Services (Compensation to States) Act, 2017

- GST Rules of Forms

- Central Goods & Service Tax Rules, 2017

- Integrated Goods & Service Tax Rules, 2017

- Goods and Services Tax Compensation Cess Rules, 2017

- Union Territories Goods & Service Tax Rules, 2017

- Union Territory Goods and Services Tax (Andaman and Nicobar Islands) Rules, 2017

- Union Territory Goods and Services Tax (Chandigarh) Rules, 2017

- Union Territory Goods and Services Tax (Dadra and Nagar Haveli) Rules, 2017

- Union Territory Goods and Services Tax (Daman and Diu) Rules, 2017

- Union Territory Goods and Services Tax (Lakshadweep) Rules, 2017

- Goods and Services Tax Settlement of Funds Rules, 2017

- Goods and Services Tax Appellate Tribunal (Appointment and Conditions of Service of President and Members) Rules, 2019

- National Anti-Profiteering Authority: Procedure and Methodology

- Tribunal Reforms Act, 2021

- Conditions of Service of Chairperson and Members of Tribunals, Appellate Tribunals and other Authorities

- Tribunal (Conditions of Service) Rules, 2021

Details

- Binding : Paperback

- Publisher : Taxmann

- Author : Taxmann

- Edition : 5th Edition 2022

- Language : English

- ISBN-10 : 9789392211393

- ISBN-13 : 9789392211393

Related

Related products

-

Add to cart

This book provides readers with the way courts have interpreted indirect tax statutes with reference to case laws, sections and delegated legislation. Arranged under major concepts, the insight provided will be beneficial to judges, justices, practitioners, tax officials and to law colleges.

-

Add to cart

Centax’s GST Tariff of India 2022-23 by R.K. Jain (2 Volumes) – 15th Edition 2022-23. This book provides complete details about the Taxability & GST Rates with amended tariff schedules as applicable from 1-1-2022. It also includes a Ready Reckoner for GST Rates, GST Notifications, Advanced Rulings & Case Laws.

-

Add to cart

Volume 1

Division 1

Referencer

Referencer 1 Goods and Services Tax Network (GSTN)

Referencer 2 Goods and Services Tax Council (GST Council)

Referencer 3 Taxes/Duties/Cesses and Surcharges Subsumed in GST

Referencer 4 Non-GST Supply

-

Add to cart

Centax’s GST ExCus 2022 by R.K. Jain. Electronic Library that gives you instant information on GST, Customs, EXIM, FEMA, Excise, Service Tax, SEZ, Money Laundering, Anti-dumping and Allied Laws simultaneously from Case Laws, Circulars, Notifications, Statutes, FAQs, Articles & GST Rates. Annual Subscription for the year 2022 (Jan-Dec).

Reviews

There are no reviews yet.