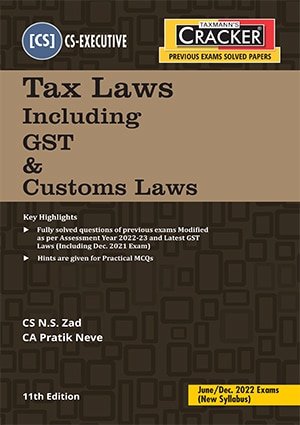

Taxmann Cracker – Tax Laws Including GST & Customs Laws (CS-Executive) (New Syllabus) by N.S Zad for June 2022 Exams – 11th Edition February 2022

Original price was: ₹350.00.₹280.00Current price is: ₹280.00.

Taxmann’s Cracker – Tax Laws Including GST & Customs Laws (CS-Executive) (New Syllabus) by N.S Zad for June 2022 Exams – 11th Edition February 2022. The most amended & updated book that covers fully solved questions of previous exams, modified as per A.Y. 2022-23 & latest GST laws. It also includes practical MCQs with hints. CS Executive | New Syllabus | June 2022 Exams.

Taxmann Cracker – Tax Laws Including GST & Customs Laws (CS-Executive) (New Syllabus) by N.S Zad for June 2022 Exams – 11th Edition February 2022

This book is prepared exclusively for the Executive Level of Company Secretary Examination requirement. It covers the entire revised, new syllabus as per ICSI.

The Present Publication is the 11th Edition for CS-Executive | New Syllabus | June/Dec. 2022 Exam, authored by CS N.S. Zad & CA Pratik Neve, with the following noteworthy features:

- Strictly as per the New Syllabus of ICSI

- Coverage of this book includes:

- All Past Exam Questions, including:

- CS Executive December 2021 | New Syllabus

- [Practical MCQs] with hints

- All Past Exam Questions, including:

- [Most Updated & Amended] Solutions in this book are provided as per the following:

- [Income Tax Solutions] as per Assessment Year 2021-22

- [GST/Customs Solutions] Amended & Updated GST Laws along with applicable Circulars/Notifications

- [Amendments] Important amendments in Finance Act, 2020 & Finance Act, 2021

- [Marks Distribution] Chapter-wise marks distribution

- [Comparison with ICSI Study Material] Chapter-wise

- Also Available:

- [MCQs] on Tax Laws

- [QUICK REVISION CHARTS] for Tax Laws

- Taxmann’s Combo for MCQs + QUICK REVISION CHARTS + CRACKER

The contents of this book are as follows

- Part I – Direct Taxes (50 Marks)

-

- Basic Concepts

- Residential Status

- Income from Salary

- Income from House Property

- Income from Business or Profession

- Income from Capital Gains

- Income from Other Sources

- Clubbing of Incomes

- Aggregation of Income and Set-off or Carry Forward of Losses

- Deductions from Total Income

- Agriculture Income & Exempted Income

- Assessment of Individual & HUF

- Assessment of Partnership Firms, LLPs, AOPs & BOI

- Assessment of Companies

- Assessment of Trust

- Return of Income

- TDS, Advance Tax, Interest Payable by/to Assessees

- Types of Assessment & Procedure of Various Assessments

- Appeals, Revisions, Settlement, Penalties, Offences & Recovery of Tax

- Offences & Penalties

- Part II – Indirect Taxes (50 Marks)

- Goods & Services Tax (GST)

- Customs Act, 1962

Details :

- Publisher : Taxmann

- Author : N S Zad

- Edition : 11th Edition February 2022

- ISBN-13 : 9789393880208

- ISBN-10 : 9789393880208

- Language : English

- Binding : Paperback

Reviews

There are no reviews yet.