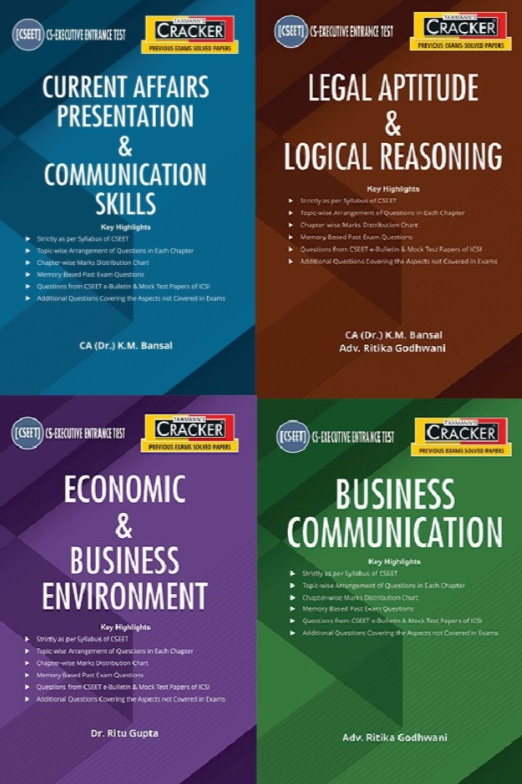

TAXMANN COMBO CRACKER CS EXECUTIVE ENTRANCE TEST (CSEET) ALL 4 SUBJECT BY KM BANSAL, RITIKA GODHWANI, RITU GUPTA APPLICABLE FOR NOVEMBER 2021 EXAMS

₹890.00 Original price was: ₹890.00.₹702.00Current price is: ₹702.00.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Related products

-

Read more

Taxmann’s Cracker – Corporate Restructuring Insolvency Liquidation & Winding-Up (CS-Professional) (New Syllabus) by Prasad Vijay Bhat for Dec 2021 Exams – 2nd Edition September 2021. This book covers topic-wise past exam questions with a sub-topic wise arrangement of questions in each chapter, chapter-wise marks distribution, trend analysis of past exam questions, ICSI Study Material comparison, etc. for CS Professional | New Syllabus.

-

Read more

Taxmann’s Cracker – Corporate Funding & Listings in Stock Exchanges (CS-Professional) (New Syllabus) by Divya Bajpai for Dec 2021 Exams – 2nd Edition September 2021. This book covers topic-wise past exam questions, chapter-wise marks distribution, trend analysis of past exam questions, ICSI Study Material comparison, etc., for CS Professional | New Syllabus.

-

Add to cart

Taxmann’s Income Tax Rules covers the annotated text of the Income-tax Rules, 1962, in the most authentic, amended & updated format. The Present Publication is the 58th Edition & Updated till Income-tax (Eighth Amendment) Rules, 2021 with the following noteworthy features: [Bestseller Series] Taxmann’s series of Bestseller Books for more than Five Decades [Zero Error] Follows …

-

Read more

Taxmann’s Cracker – Financial Management & Economics for Finance (CA-Intermediate) (New Syllabus) by Namit Arora for Nov 2021 Exams – 1st Edition September 2021. This book covers past exam questions, including the July 2021 CA-Inter Exam, questions from RTPs & MTPs of ICAI, and solved model test papers on CA Exam Pattern. It also includes trend analysis for past exams, including chapter-wise marks distribution. Lastly, it features chapter-wise summary notes with relevant formulae.

Reviews

There are no reviews yet.