Practical Guide To GST On Automobile Industry //– 8th Edition 2021 By [CA Madhukar N. Hiregange] {Bharat’s}

₹999.00 Original price was: ₹999.00.₹749.00Current price is: ₹749.00.

Bharat’s Practical Guide to GST on Automobile Industry by CA Madhukar N. Hiregange – 1st Edition 2021.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Practical Guide To GST On Automobile Industry /– 8th Edition 2021 By CA Madhukar N. Hiregange

Bharat’s Practical Guide to GST on Automobile Industry by CA Madhukar N. Hiregange – 1st Edition 2021.

About Practical Guide to GST on Automobile Industry

Chapter 1 Introduction to Automobile Industry

Chapter 2 Overview of GST

Chapter 3 Implications on Outward Supplies — OEM and Component Manufacturers

Chapter 4 Classification, Rate of Tax and Exemptions — OEM and Component Manufacturers

Chapter 5 Automobile Dealers

Chapter 6 Authorised Service Centres & Garages

Chapter 7 Job work in Original Equipment & Component Manufacturing

Chapter 8 Overview of Input Tax Credit

Chapter 9 ITC on Capital Assets — Original Equipment’s and Parts & Components Manufacturers in Automobile Industry

Chapter 10 ITC on Direct procurements & Other Expenses — OEM & Component Manufacturers in Automobile Industry

Chapter 11 ITC on Direct Procurements & Other Expenses — Automobile Dealers & Service Stations

Chapter 12 Implications under Reverse Charge Mechanism

Chapter 13 Registration

Chapter 14 E-invoicing and Documentation

Chapter 15 Returns and Payments

Chapter 16 Types of Refunds under GST

Chapter 17 E-way Bill

Details :

- Author : CA Madhukar N. Hiregange (CA. Ravi Kumar Somani CA. Vikram Katariya CA. Vini Patni)

- Edition : 1st Edition 2021

- ISBN-13 : 9789390854202

- ISBN-10 : 9789390854202

- Language : English

- Binding : Paperback

Related

| color | Gray |

|---|

Related products

-

Add to cart

Tax Publisher’s GST Practice Source Book by Satyadev Purohit – 2022 Edition. First ever Authored such Book on GST covering each and every important item needed for under standing and practicing GST. Encompassing CGST Act, IGST Act and UTGST Act, as amended to date. Entirely new concept in GST law authorship through Section wise arrangement …

-

Add to cart

Bloomsbury Jurisprudence Under GST Law Analysis Of Notable Case Laws Edition 2021 ~ {Nitya Tax Associates}

-

Add to cart

Taxmann’s GST Tariff with GST Rate Reckoner (Set of 2 Volumes) – 16th Edition February 2022. This book provides GST Tariff for Goods and Services with amended tariff schedule as applicable from 1-1-2022. It provides HSN-wise and SAC-wise Tariff of all the Goods and Services along with GST Tariff Notifications (rate of tax & exemptions), Latest Clarifications, Case Laws and Explanatory Notes.

-

Add to cart

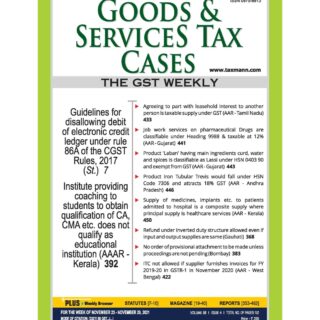

Taxmann’s GST Cases is a weekly in-print Journal that is delivered at your doorstep every week. This Journal is made for professionals, by the professionals, with a focus on the analysis of the latest statutory & judicial changes.

![Practical Guide To GST On Automobile Industry //– 8th Edition 2021 By [CA Madhukar N. Hiregange] {Bharat’s}](https://neupinch.com/wp-content/uploads/2021/11/9789390854202-1.jpg)

Reviews

There are no reviews yet.