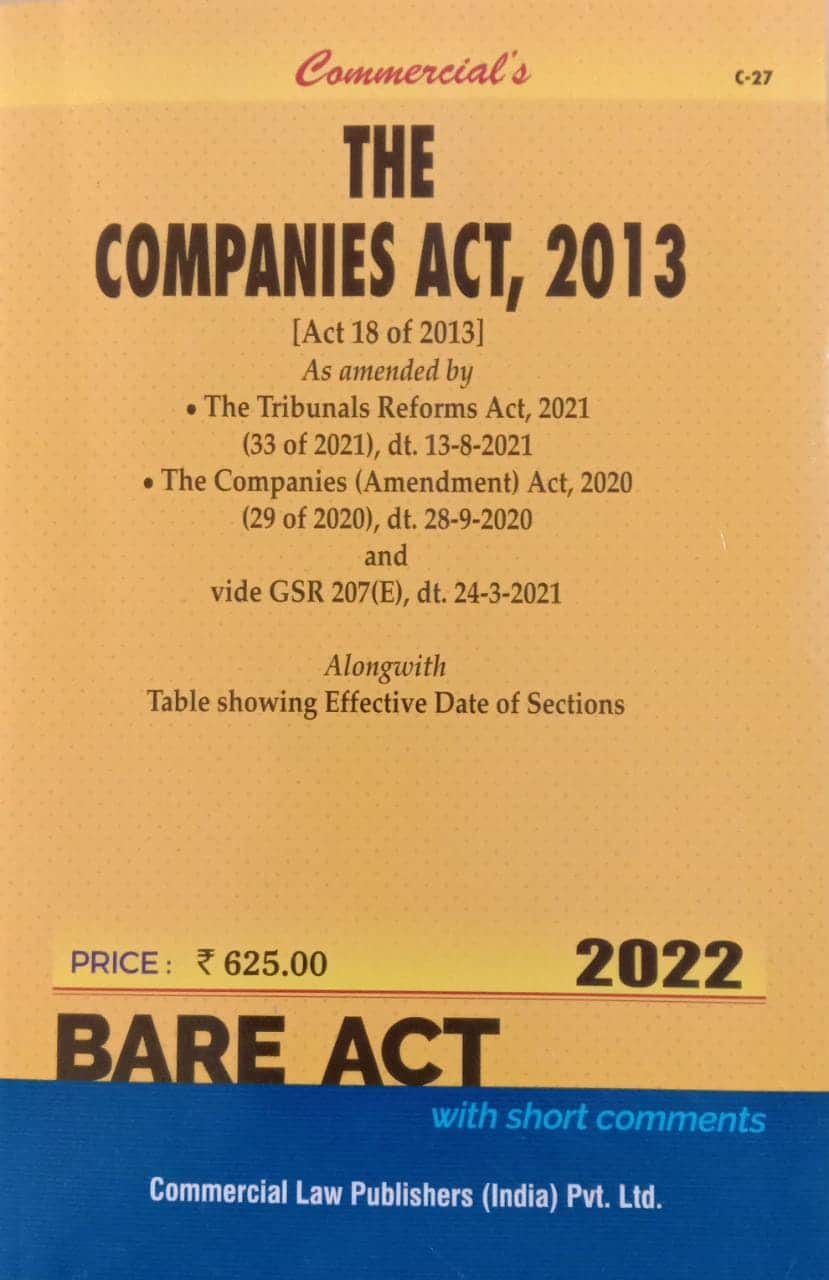

Commercial’s The Companies Act, 2013 (Bare Act) – Edition 2022

₹625.00 Original price was: ₹625.00.₹450.00Current price is: ₹450.00.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Commercial’s The Companies Act, 2013 (Bare Act) – Edition 2022.

Details :-

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Commercial

- Edition : 2022

- ISBN-13 : 9789392141119

- ISBN-10 : 9789392141119

- Language : English

- Binding : Paperback

Related

Related products

-

Read more

Taxmann’s Companies Act with Rules is the most authentic and comprehensive book, in a Pocket Paperback format, on Companies Act, 2013. It covers the Amended, Updated & Annotated text of the Companies Act, 2013 (‘Act’) and the Rules prescribed thereunder along with Circulars & Notifications [as amended by the Companies (Amendment) Act 2020]. This book …

-

Add to cart

This book aims to explain the readers how to read, understand, analyse and interlink the voluminous information available in the financial statement with the help of charts, case analysis, etc. In other words, this book provides in-depth analysis, stepwise approach with the use of case analysis, to understand & decode the financial statements.

-

Read more

Taxmann’s Company Law Manual is a compendium of Companies Act, 2013 along with Relevant Rules framed thereunder. In other words, it contains Compilation of Amended, Updated & Annotated text of the Companies Act, 2013 [as amended by the Companies (Amendment) Act, 2020] along with Amended Schedules (III & V), Circulars, Notifications, SS-1 to SS-4, and ICSI Guidance Note on CSR.

-

Read more

Taxmann’s CLASS NOTES for Indirect Tax Laws is a one-stop solution to conquer the vast subject of Indirect Taxation with ease. The objective behind this book is to explain the complicated provisions of the law in a simplified manner with the help of charts & diagrams. This book covers the following laws: GST Act Customs Act …

Reviews

There are no reviews yet.