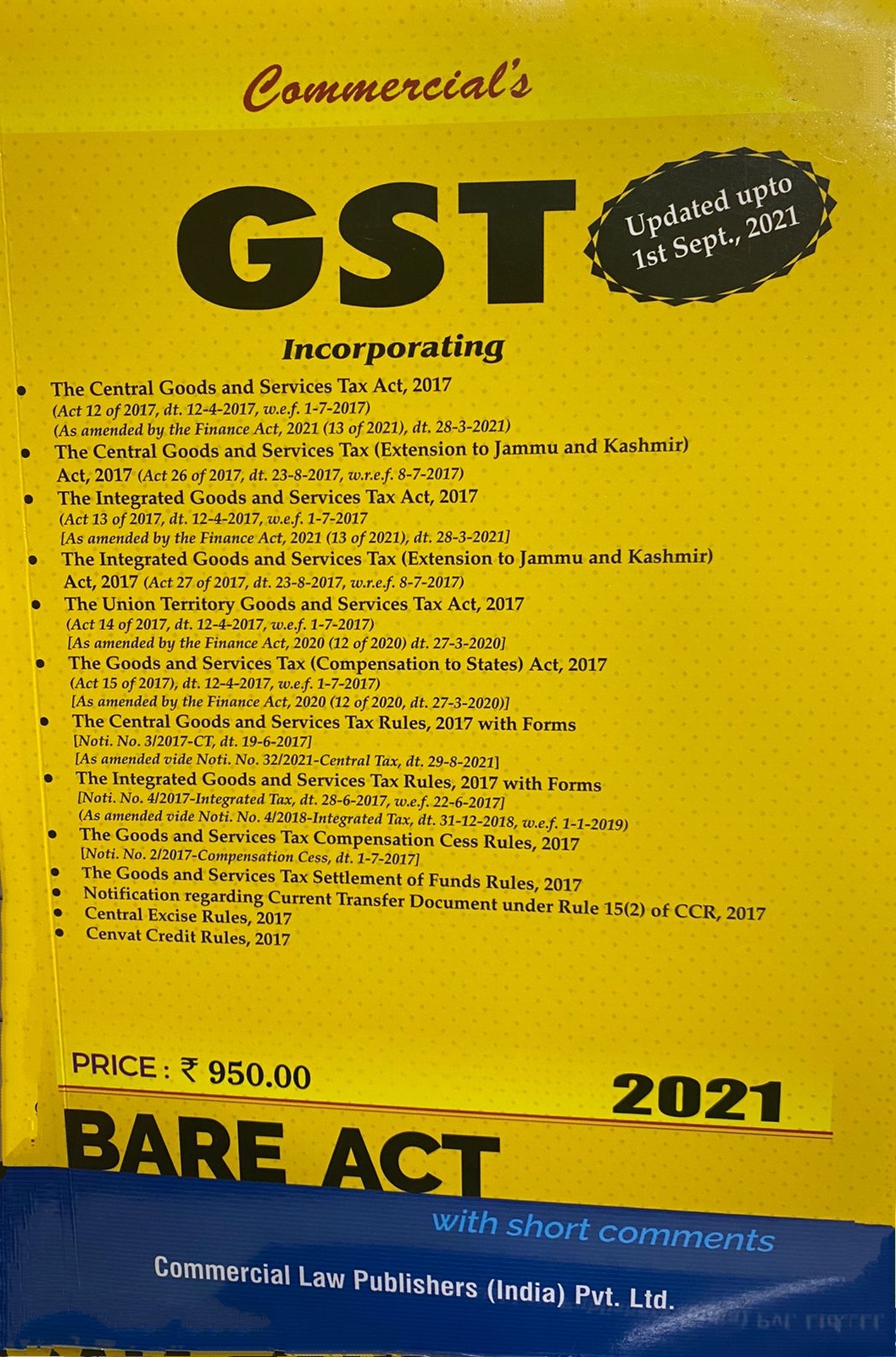

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021

₹950.00 Original price was: ₹950.00.₹620.00Current price is: ₹620.00.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Incorporating

- The Central Goods and Services Tax Act, 2017

(Act 12 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

(As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021) - The Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 26 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Integrated Goods and Services Tax Act, 2017

(Act 13 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017

[As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021] - The Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 27 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Union Territory Goods and Services Tax Act, 2017

(Act 14 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

lAs amended by the Finance Act, 2020 (12 of 2020) dt. 27-3-2020] - The Goods and Services Tax (Compensation to States) Act, 2017

(Act 15 of 2017), dt 12-4-2017, w.e.f. 1-7-2017)

[As amended by the Finance Act, 2020 (12 of 2020, dt. 27-3-2020)] - The Central Goods and Services Tax Rules, 2017 with Forms

- The Integrated Goods and Services Tax Rules, 2017 with Forms

[Noti. No. 4/2017-lntegrated Tax, dt. 28-6-2017, w.e.f. 22-6-2017] (As amended vide Noti. No. 4/2018-Integrated Tax, dt. 31-12-2018, w.e.f. 1-1-2019)

Noti. No. 3/2017-CT, dt. 19-6-2017] [As amended vide Noti. No. 2712021-Central Tax, dt. 1-6-2021, w.e.f. 1-6-2021] - The Goods and Services Tax Compensation Cess Rules, 2017

[Noti. No. 212017-Compensation Cess, dt. 1-7-2017] - The Goods and Services Tax Settlement of Funds Rules, 2017

- Notification regarding Current Transfer Document under Rule 15(2) of CCR, 2017

- Central Excise Rules, 2017

- Cenvat Credit Rules, 2017

Details :-

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Commercial

- Edition : SEPTEMBER, 2021

- ISBN-13 : 9789390926886

- ISBN-10 : 9789390926886

- Pages : 925 pages

- Language : English

- Binding : Paperback

Related

Related products

-

Add to cart

This book will equip professionals with necessary knowledge tools to practice in NCLT/NCLAT, acting as their non-verbal guide. Whether it is oppression and mismanagement cases or winding up/liquidation matters, mergers/de-mergers, or class actions or an insolvency case, this book helps find answers to most practical problems. For a new practitioner, this book provides the necessary …

-

Add to cart

Centax’s GST ExCus 2022 by R.K. Jain. Electronic Library that gives you instant information on GST, Customs, EXIM, FEMA, Excise, Service Tax, SEZ, Money Laundering, Anti-dumping and Allied Laws simultaneously from Case Laws, Circulars, Notifications, Statutes, FAQs, Articles & GST Rates. Annual Subscription for the year 2022 (Jan-Dec).

-

Add to cart

This book provides readers with the way courts have interpreted indirect tax statutes with reference to case laws, sections and delegated legislation. Arranged under major concepts, the insight provided will be beneficial to judges, justices, practitioners, tax officials and to law colleges.

-

Add to cart

CA Madhukar N Hiregange, [B.Com., FCA, DISA, Passed CISA], is a senior partner at a multi-locational firm in India. He has jointly authored 23 books on Central Excise, Service Tax, Karnataka VAT and Excise/Service Tax Audit, IDT – IPCC Study Material, Central Sales Tax, GST – A Primer-2 Editions, GST Classification & Exemption 2017, Compendium of Issues and Solutions in GST – March 2018/ May 2019 and GST Tariff – October 2018. He is also working on Beginners Handbook on GST and 2 sectoral books on GST on Textiles/ Real Estate, slated to be published in November 2019. He is constantly active in spreading awareness about Indirect Taxes through seminars, articles, linkedin, facebook, youtube, caclubindia.com & hiregangeacademy.com, etc. He had been a Central Council Member, ICAI, for the term 2010-13 & 2106- 19, with a vision of enhancing the credibility of the profession and strengthening the professionals in practice and employment. He had also served as Chairman of the Indirect Tax Committee, for the year 2012 and term 2016-19, with the privilege of leading a wonderful and contributing team for 4 years.

Reviews

There are no reviews yet.