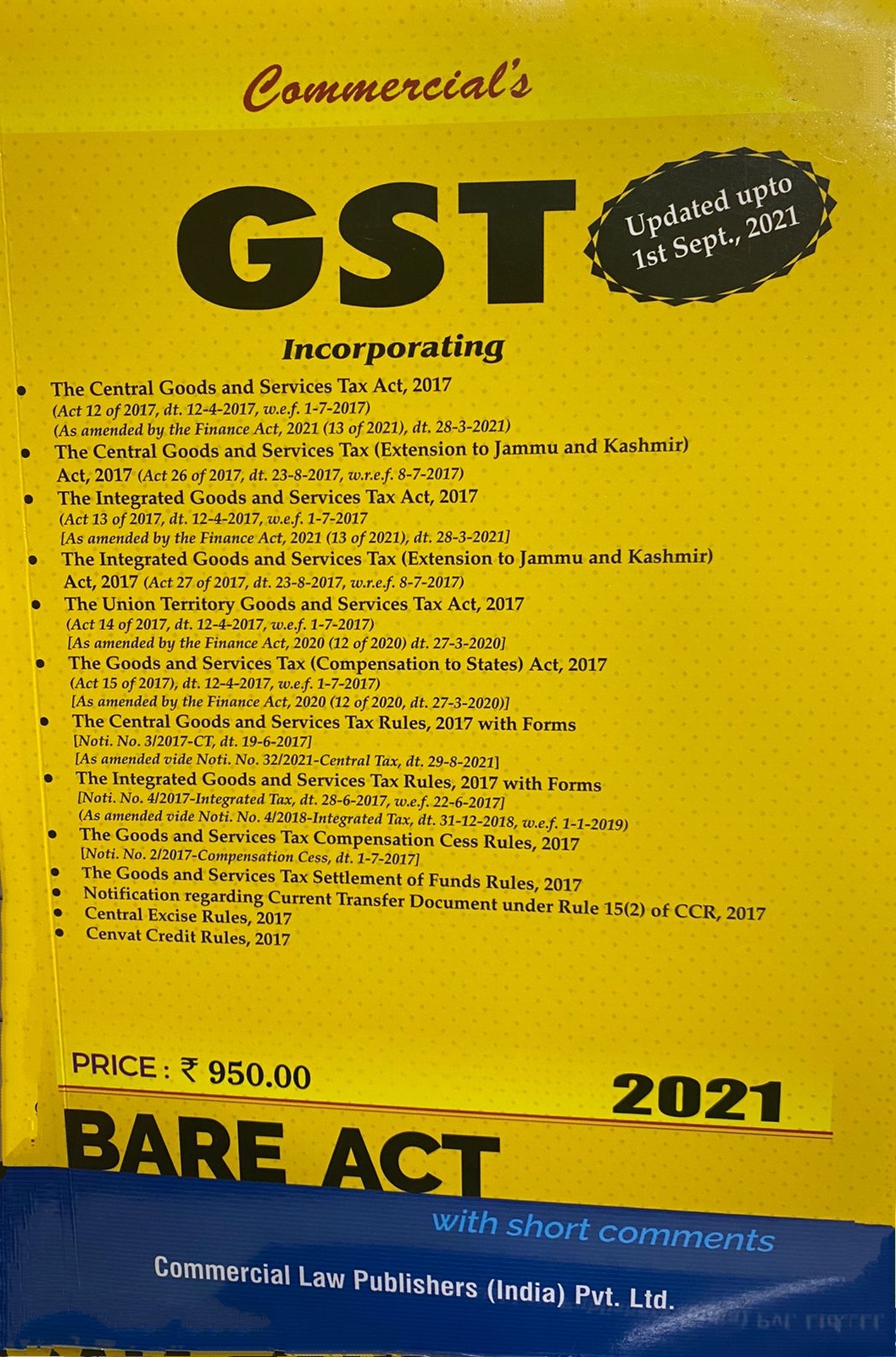

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021

₹950.00 Original price was: ₹950.00.₹620.00Current price is: ₹620.00.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Commercial’s GST Acts Along with Rules (Bare Act) – Updated upto 1ST SEPTEMBER 2021.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Incorporating

- The Central Goods and Services Tax Act, 2017

(Act 12 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

(As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021) - The Central Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 26 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Integrated Goods and Services Tax Act, 2017

(Act 13 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017

[As amended by the Finance Act, 2021 (13 of 2021), dt. 28-3-2021] - The Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017 (Act 27 of 2017, dt. 23-8-2017, w.r.e.f. 8-7-2017)

- The Union Territory Goods and Services Tax Act, 2017

(Act 14 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

lAs amended by the Finance Act, 2020 (12 of 2020) dt. 27-3-2020] - The Goods and Services Tax (Compensation to States) Act, 2017

(Act 15 of 2017), dt 12-4-2017, w.e.f. 1-7-2017)

[As amended by the Finance Act, 2020 (12 of 2020, dt. 27-3-2020)] - The Central Goods and Services Tax Rules, 2017 with Forms

- The Integrated Goods and Services Tax Rules, 2017 with Forms

[Noti. No. 4/2017-lntegrated Tax, dt. 28-6-2017, w.e.f. 22-6-2017] (As amended vide Noti. No. 4/2018-Integrated Tax, dt. 31-12-2018, w.e.f. 1-1-2019)

Noti. No. 3/2017-CT, dt. 19-6-2017] [As amended vide Noti. No. 2712021-Central Tax, dt. 1-6-2021, w.e.f. 1-6-2021] - The Goods and Services Tax Compensation Cess Rules, 2017

[Noti. No. 212017-Compensation Cess, dt. 1-7-2017] - The Goods and Services Tax Settlement of Funds Rules, 2017

- Notification regarding Current Transfer Document under Rule 15(2) of CCR, 2017

- Central Excise Rules, 2017

- Cenvat Credit Rules, 2017

Details :-

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Commercial

- Edition : SEPTEMBER, 2021

- ISBN-13 : 9789390926886

- ISBN-10 : 9789390926886

- Pages : 925 pages

- Language : English

- Binding : Paperback

Related

Related products

-

Add to cart

Bloomsbury Jurisprudence Under GST Law Analysis Of Notable Case Laws Edition 2021 ~ {Nitya Tax Associates}

-

Add to cart

Taxmann’s Income Tax Act covers the annotated text of the Income-tax Act, 1961, in the most authentic, amended & updated format. The Present Publication is the 66th Edition & Updated till the following: The Finance Act, 2021 The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 The noteworthy features of the book …

-

Add to cart

This book will equip professionals with necessary knowledge tools to practice in NCLT/NCLAT, acting as their non-verbal guide. Whether it is oppression and mismanagement cases or winding up/liquidation matters, mergers/de-mergers, or class actions or an insolvency case, this book helps find answers to most practical problems. For a new practitioner, this book provides the necessary …

-

Add to cart

Taxmann’s Income Tax Rules covers the annotated text of the Income-tax Rules, 1962, in the most authentic, amended & updated format. The Present Publication is the 58th Edition & Updated till Income-tax (Eighth Amendment) Rules, 2021 with the following noteworthy features: [Bestseller Series] Taxmann’s series of Bestseller Books for more than Five Decades [Zero Error] Follows …

Reviews

There are no reviews yet.