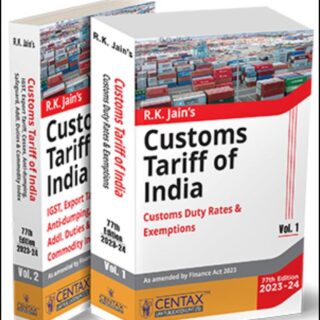

Centax Customs Tariff of India (Set of 2 Volumes) By R K Jain Edition June 2023

Original price was: ₹3,995.00.₹3,395.00Current price is: ₹3,395.00.

Description

This book covers the following:

- Customs Duty Rates & Exemptions

- Export Tariff

- IGST

- Cesses & Additional Duties

- Safeguard Duties

- Anti-dumping Duty & Countervailing Duty

- Commodity Index

It also incorporates basic details such as:

- How to use this Tariff?

- How to calculate the effective rate of import duty

The Present Publication is the 77th Edition | 2023-24 and has been amended by the Finance Act 2023. This book is edited by R.K. Jain. It is divided into eight parts:

- Part 1 – Customs Tariff Act, 1975

- Contains revised and up-to-date annotated text of the Customs Tariff Act, 1975

- Part 2 – Export Tariff

- Export Tariff (Second Schedule of Customs Tariff Act, 1975) along with the Exemption Notifications

- Part 3 – Integrated Goods & Services Tax (IGST)

- Bird’s eye view of IGST

- IGST Notifications relating to Law and Procedure

- IGST Rates Notifications

- Fully Exempted IGST Goods (Nil Rated) – Notifications

- IGST Exemption Notifications

- Part 4 – Cesses and Additional Duties

- Cesses, Additional Duties, Special Duty, Other Levies, etc.

- Determination of Origin of Goods Rules

- Validating Provisions & Notifications

- Part 5 – Safeguard Duties

- Part 6 – Anti-dumping Duty and Countervailing Duty

- Rules for Anti-Dumping Duty, Countervailing Duty

- Notifications imposing Anti-Dumping Duty

- Notifications imposing CVD

- Part 7 – Commodity Index

- Commodity Index

- Chronological List of Basic Notifications

About the author

Sh. R.K. Jain, the renowned author of Indirect Taxes including Customs, Central Excise, Service Tax, Foreign Trade Policy (FTP), GST and FEMA. He made his debut in early seventies and in the year 1975, he brought out Customs & Excise Tariffs and Manuals which have recently celebrated Silver/ Golden Jubilee Editions.

Excise Law Times (E.L.T.) edited by Sh. R.K. Jain was launched nearly 45 years ago and it brought awakening in the field of Central Excise and Customs. It has grown to be the prime journal on the subject with largest circulation.

Another Journal, ‘Service Tax Review’ was started in the year 2006 and finally R.K. Jain’s GST Law Times was introduced in 2017, after the advent of GST, the major Indirect Tax Reform. EXCUS is the digital version of these Journals.

Reviews

There are no reviews yet.