“Bloomsbury’s A Practical Guide To GST On Real Estate Industry ~ 23 September 2020 By {CA Madhukar N Hiregange, CA Virender Chauhan, CA Sudhir VS And CA Roopa Nayak} 9789390077991” has been added to your cart. View cart

Sale!

Sale!

Tax Planning (As Amended By The Finance Act, 2021) – 11th Edition August 2021 [By S Rajaratnam] {Bharat Law Publication’s}

₹3,500.00 Original price was: ₹3,500.00.₹2,499.00Current price is: ₹2,499.00.

BLP’s Tax Planning (As Amended by The Finance Act, 2021) by S Rajaratnam – 11th Edition Thoroughly revised and updated August 2021.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Nextdoor (Opens in new window) Nextdoor

Tax Planning (As Amended By The Finance Act, 2021) – 11th Edition August 2021 [By S Rajaratnam] {Bharat Law Publication’s}

Details :

- Publisher : Bharat law Publications

- Author : S Rajaratnam

- Edition : 11th Edition August 2021

- ISBN-13 : 9788173460753

- ISBN-10 : 9788173460753

- Language : English

- Binding : Hardbound

Related

| color | Blue |

|---|

Be the first to review “Tax Planning (As Amended By The Finance Act, 2021) – 11th Edition August 2021 [By S Rajaratnam] {Bharat Law Publication’s}” Cancel reply

Categories: Bharat’s, Most Popular, New Arrivals, Taxation

Tags: Financial, Taxation

Related products

-

-

Add to cart

Volume 1

Division 1

Referencer

Referencer 1 Goods and Services Tax Network (GSTN)

Referencer 2 Goods and Services Tax Council (GST Council)

Referencer 3 Taxes/Duties/Cesses and Surcharges Subsumed in GST

Referencer 4 Non-GST Supply

-

-

Add to cart

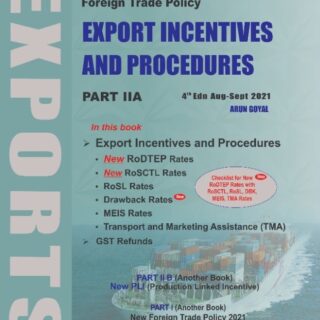

BIG’s Easy Reference Foreign Trade Policy 2021 (2 volumes) by Arun Goyal – 4th Edition Aug-Sept 2021

![Tax Planning (As Amended By The Finance Act, 2021) – 11th Edition August 2021 [By S Rajaratnam] {Bharat Law Publication’s}](https://neupinch.com/wp-content/uploads/2021/11/Bharat-Law-Publications-Tax-Planning-As-Amended-By-The-Finance-Act-2021-–-11th-Edition-August-2021-By-S-Rajaratnam.webp)

!["Bharat’s" Guide To Insolvency & Bankruptcy Code / 3rd Edition 2021 By [Dr. D. K. Jain] 9789390854059](https://neupinch.com/wp-content/uploads/2021/11/Bharats-Guide-To-Insolvency-Bankruptcy-Code-–-3rd-Edition-2021-By-Dr.-D.-K.-Jain-286x320.jpeg)

![Practical Guide To GST On Automobile Industry //– 8th Edition 2021 By [CA Madhukar N. Hiregange] {Bharat’s}](https://neupinch.com/wp-content/uploads/2021/11/9789390854202-1.jpg)

Reviews

There are no reviews yet.