BHARAT GST CASE DIGEST BY RAJAT MOHAN OCTOBER 2021 EDITION

₹2,999.00 Original price was: ₹2,999.00.₹2,099.00Current price is: ₹2,099.00.

Bharat’s GST Case Digest including Integrated Goods and Services Tax Act, 2017 By Rajat Mohan – 3rd Edition 2021.

About GST Case Digest including Integrated Goods and Services Tax Act, 2017

Bharat’s GST Case Digest including Integrated Goods and Services Tax Act, 2017 By Rajat Mohan – 3rd Edition 2021.

About GST Case Digest including Integrated Goods and Services Tax Act, 2017

Chapter I

Preliminary

1. Short title, extent and commencement

2. Definitions

(1) “actionable claim”

(2) “address of delivery”

(3) “address on record”

(4) “adjudicating authority”

(5) “agent”

(6) “aggregate turnover”

(7) “agriculturist”

(8) “Appellate Authority”

(9) “Appellate Tribunal”

(10) “appointed day”

(11) “assessment”

(12) “associated enterprises”

(13) “audit”

(14) “authorised bank”

(15) “authorised representative”

(16) “Board”

(17) “business”

(18) * * *

(19) “capital goods”

(20) “casual taxable person”

(21) “central tax”

(22) “cess”

(23) “chartered accountant”

(24) “Commissioner”

(25) “Commissioner in the Board”

(26) “common portal”

(27) “common working days”

(28) “company secretary”

(29) “competent authority”

(30) “composite supply”

(31) “consideration”

(32) “continuous supply of goods”

(33) “continuous supply of services”

(34) “conveyance”

(35) “cost accountant”

(36) “Council”

(37) “credit note”

(38) “debit note”

(39) “deemed exports”

(40) “designated authority”

(41) “document”

(42) “drawback”

(43) “electronic cash ledger”

(44) “electronic commerce”

(45) “electronic commerce operator”

(46) “electronic credit ledger”

(47) “exempt supply”

(48) “existing law”

(49) “family”

(50) “fixed establishment”

(51) “Fund”

(52) “goods”

(53) “Government”

(54) “Goods and Services Tax (Compensation to States) Act”

(55) “goods and services tax practitioner”

(56) “India”

(57) “Integrated Goods and Services Tax Act”

(58) “integrated tax”

(59) “input”

(60) “input service”

(61) “Input Service Distributor”

(62) “input tax”

(63) “input tax credit”

(64) “intra-State supply of goods”

(65) “intra-State supply of services”

(66) “invoice” or “tax invoice”

(67) “inward supply”

(68) “job work”

(69) “local authority”

(70) “location of the recipient of services”

(71) “location of the supplier of services”

(72) “manufacture”

(73) “market value”

(74) “mixed supply”

(75) “money”

(76) “motor vehicle”

(77) “non-resident taxable person”

(78) “non-taxable supply”

(79) “non-taxable territory”

(80) “notification”

(81) “other territory”

(82) “output tax”

(83) “outward supply”

(84) “person”

(85) “place of business”

(86) “place of supply”

(87) “prescribed”

(88) “principal”

(89) “principal place of business”

(90) “principal supply”

(91) “proper officer”

(92) “quarter”

(93) “recipient”

(94) “registered person”

(95) “regulations”

(96) “removal”

(97) “return”

(98) “reverse charge”

(99) “Revisional Authority”

(100) “Schedule”

(101) “securities”

(102) “services”

(103) “State”

(104) “State tax”

(105) “supplier”

(106) “tax period”

(107) “taxable person”

(108) “taxable supply”

(109) “taxable territory”

(110) “telecommunication service”

(111) “the State Goods and Services Tax Act”

(112) “turnover in State” or “turnover in Union territory”

(113) “usual place of residence”

(114) “Union territory”

(115) “Union territory tax”

(116) “Union Territory Goods and Services Tax Act”

(117) “valid return”

(118) “voucher”

(119) “works contract”

(120) words and expressions

(121) * * *

Chapter II

Administration

3. Officers under this Act

4. Appointment of officers

5. Powers of officers

6. Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances

Chapter III

Levy and Collection of Tax

7. Scope of supply

8. Tax liability on composite and mixed supplies

9. Levy and collection

10. Composition levy

11. Power to grant exemption from tax

Chapter IV

Time and Value of Supply

12. Time of supply of goods

13. Time of supply of services

14. Change in rate of tax in respect of supply of goods or services

15. Value of taxable supply

Chapter V

Input Tax Credit

16. Eligibility and conditions for taking input tax credit

17. Apportionment of credit and blocked credits

18. Availability of credit in special circumstances

19. Taking input tax credit in respect of inputs and capital goods sent for job-work

20. Manner of distribution of credit by Input Service Distributor

21. Manner of recovery of credit distributed in excess

Chapter VI

Registration

22. Persons liable for registration

23. Persons not liable for registration

24. Compulsory registration in certain cases

25. Procedure for registration

26. Deemed registration

27. Special provisions relating to casual taxable person and non-resident taxable person

28. Amendment of registration

29. Cancellation or suspension of registration

30. Revocation of cancellation of registration

Chapter VII

Tax Invoice, Credit and Debit Notes

31. Tax invoice

31A. Facility of digital payment to recipient

32. Prohibition of unauthorised collection of tax

33. Amount of tax to be indicated in tax invoice and other documents

34. Credit and debit notes

Chapter VIII

Accounts and Records

35. Accounts and other records

36. Period of retention of accounts

Chapter IX

Returns

37. Furnishing details of outward supp

Details :

Publisher : Bharat Law House Pvt. Ltd.

Author : Rajat Mohan

Edition : 3rd Edition 2021

ISBN-13 : 9789390854400

ISBN-10 : 9789390854400

Binding : Paperback

Language : English

Related

| color | Gray |

|---|

Related products

-

Add to cart

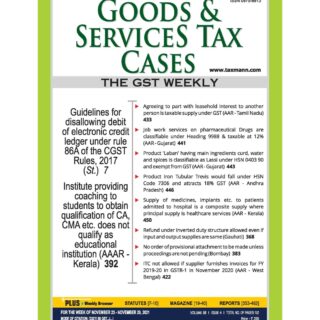

Taxmann’s GST Acts (Bare Act) As Amended by Finance Act 2021 – 6th Edition December 2021. Covering Amended, Updated & Annotated text of the CGST/IGST/UTGST/GST Compensation to States Acts [updated till 15th December 2021 & amended by the Finance Act 2021]. What sets it apart is the presentation of the GST Act(s), along with Reference to Relevant Rules, Forms, Notifications to & Circulars. The readers also get a specially curated Guide to GST along with the above.

![Practical Guide To GST On Automobile Industry //– 8th Edition 2021 By [CA Madhukar N. Hiregange] {Bharat’s}](https://neupinch.com/wp-content/uploads/2021/11/9789390854202-1.jpg)

Reviews

There are no reviews yet.