Category: Uncategorized

Showing 21–40 of 78 results

-

Add to cart

A Ramaiya, Guide to the Companies Act is a section-based commentary of the Companies Act, 2013. Widely recognised as the most thorough and comprehensive reference work on corporate law, this book has been relied on and cited in various judgments of the Supreme Court as well as High Courts. Since its first publication in 1956, this …

-

Add to cart

Universal’s CLAT Solved papers provides CLAT solved previous year question papers catering to the need of the various candidates preparing for the law entrance examinations. It provides last 13 years questions papers of CLAT and NLU Delhi. It is an indispensable and useful guide for the students preparing for law entrance examinations. Key Features: Provides …

-

Add to cart

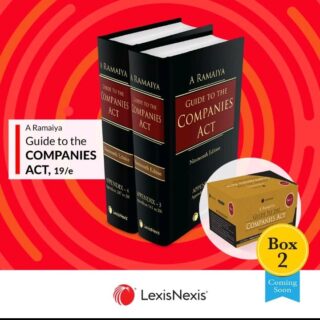

A Ramaiya, Guide to the Companies Act is a section-based commentary of the Companies Act, 2013. Widely recognised as the most thorough and comprehensive reference work on corporate law, this book has been relied on and cited in various judgments of the Supreme Court as well as High Courts. Since its first publication in 1956, this work has exceptionally stood out in every way – for its meticulous research, well-written commentary, description of legislative intent, succinct coverage of Indian and foreign judicial precedents, procedural rules, notifications, clarifications and circulars.

-

Add to cart

A Ramaiya Guide to the Companies Act is the most comprehensive and authoritative section-wise commentary on the Companies Act 2013. A companion to the recently published Box 1, this Box 2 contains completely revamped appendices, ranging from Appendix 141 to 284, covering rules and regulations governing companies, along with other allied legislations.

-

Add to cart

Chaturvedi and Pithisaria’s Income Tax Law has carved a niche for itself as an authentic and comprehensive treatise on income tax law. This work embodies systematised analysis of the principles of income tax law on one hand, while imparting practical guidance on the other. Various facets of the law have been addressed with precision and clarity, accompanied by ample illustrations. This ten-volume set is an essential reference for professionals, owing to its meticulous approach and brilliant exposition of the principles of income tax law.

-

Read more

MMD’s Direct Tax Question and Answer Compiler (CA Final) – (Old /New Syllabus) by CA Bhanwar Borana for Nov 2021 Exam. Details : Publisher : Make My Delivery Author : CA Bhanwar Borana Edition : Edition 2021 ISBN-13 : ISBN-10 : Binding : Paperback Language : English MMD’s Direct Tax Compact (CA Final) (2 Volumes) – (Old …

-

Read more

MMD’s Direct Tax Compact (CA Final) (2 Volumes) – (Old /New Syllabus) by CA Bhanwar Borana for Nov 2021 Exam. Details : Publisher : Make My Delivery Author : CA Bhanwar Borana Edition : Edition 2021 ISBN-13 : ISBN-10 : Binding : Paperback Language : English

-

Read more

MMD’s Direct Tax Question and Answer Compiler (CA Final) – (Old /New Syllabus) by CA Bhanwar Borana for Nov 2021 Exam. Details : Publisher : Make My Delivery Author : CA Bhanwar Borana Edition : Edition 2021 ISBN-13 : ISBN-10 : Binding : Paperback Language : English

-

Add to cart

Nabhi’s Annual Compendium of Govt Orders and Case Law Digest on Govt Service Rules 2020 – Edition 2021.

-

Add to cart

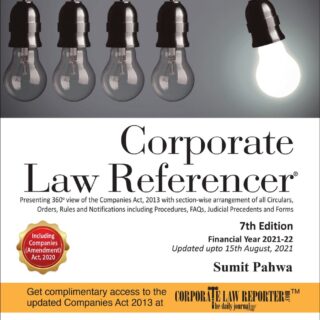

Updated with Companies (Amendment) Act, 2020 Compliance checklists and tables on Compliances for Listed Companies under the LODR, Takeover and Insider Trading Regulations Section is the King – All Circulars, Orders, Rules and Notifications (CORN) including Procedures, FAQs and Judicial Precedents have been placed below the relevant section Annual editions regularly updated to incorporate legislative …

-

Add to cart

Accelerating India: 7 Years of Modi Government qualitatively and quantitatively evaluates the policies of the government in the last 7 years and their impact on the citizens and the nation

-

Add to cart

Oakbridge’s COVID 19 : Genocide Without Parallel Chronicles of ‘Dragon’ Let Loose, World Economy, Taxation & Vaccination by Shailendra Kumar – 1st Edition 2021.

-

Add to cart

Oakbridge’s Practical Guide to Drafting Commercial Contracts by Bhumesh Verma 2nd Edition 2020.

-

Add to cart

Snow White’s First Lessons in Financial Reporting (CA-Final) (New Syllabus) (2 Volumes) by M.P.Vijay Kumar for May 2022 Exams – January 2022 Edition.

-

-

Read more

Taxmann’s Auditing & Assurance is prepared exclusively for the Intermediate Level of Chartered Accountancy Examination requirement. It covers the entire revised syllabus as per ICAI under the New Scheme of Education and Training.

-

Read more

Taxmann’s Companies Act with Rules is the most authentic and comprehensive book, in a Pocket Hardbound format, on Companies Act, 2013. It covers the Amended, Updated & Annotated text of the Companies Act, 2013 (‘Act’) and the Rules prescribed thereunder along with Circulars & Notifications [as amended by the Companies (Amendment) Act 2020].

-

Add to cart

Taxmann’s Company Law and Practice – A Comprehensive Text Book on Companies Act 2013 by G K Kapoor – 25th Edition September 2021. Company Law & Practice is the most amended & updated book to represent an impressive and judicious blending of the provisions of the Companies Act, Judicial Decisions, Clarifications issued by SEBI, etc. The text is interspersed with interpretations, explanations & illustrations to help the reader assimilate the provisions better.

-

Read more

Taxmann’s CRACKER for Advanced Auditing & Professional Ethics is prepared exclusively for the requirement of the Final Level of Chartered Accountancy Examination. It covers the entire revised, new syllabus as per ICAI.

-

Read more

Taxmann’s Cracker – Advanced Tax Laws (CS-Professional) (New Syllabus) by Pratik Neve for Dec 2021 Exams – 2nd Edition February 2021. This book covers topic-wise past exam questions, chapter-wise marks distribution, trend analysis of past exam questions, ICSI Study Material comparison, etc., for CS Professional | New Syllabus. Solutions are provided as per Assessment Year 2021-22 & Finance Act 2020.