Category: NEW RELEASES

Showing 381–400 of 574 results

-

Add to cart

This book covers the subject matter in a summarised tabular chart format, point-wise summaries, etc. This book is amended upto 30th November 2021, covering the latest applicable provisions and amendments. CS-Executive | New Syllabus | June 2022 Exams.

-

Add to cart

Taxmann’s Registrars to an Issue and Share Transfer Agents – Corporate by National Institute of Securities Markets (NISM) – Edition December 2021. Covering all important aspects of the Registrar and Transfer Agents (RTA) functioning in Corporates. These include the basic understanding of the Indian securities markets, the role and function of RTA in corporate securities issuance and transaction process, and the regulatory environment in which the RTAs operate in India.

-

Add to cart

Taxmann’s Registrars to an Issue and Share Transfer Agents – Mutual Funds by National Institute of Securities Markets (NISM) – Edition December 2021. Covering all important aspects of the Registrar and Transfer Agents (RTA) functioning in Mutual Funds. These include the basic understanding of the Indian securities markets, the role and function of RTA in mutual fund issuance and transaction process, and the regulatory environment in which the RTAs operate in India.

-

Add to cart

This book is the most updated & amended compendium of the annotated text of the Acts/Rules/Regulations/Circulars/Master Circulars, etc., on SEBI & Securities Laws in India. What sets this book apart is the Circulars amending/Clarifying the primary Circular are given together to give a complete picture.

-

Add to cart

Taxmann’s Statutory Guide for NBFCs – 26th Edition 2022. Comprehensive coverage on Laws relating to NBFCs. It covers Updated, Amended & Annotated text of Directions/Master Directions, Circulars, Notifications, RBI Guidelines, Rules/Regulations, Clarifications, Orders, etc.

-

Add to cart

Taxmann’s flagship publication for Students’ on Income Tax & GST Laws with a specific focus on New Problems & Different Solutions. Besides illustrations & solved problems, it also contains unsolved exercises based on the readers’ queries received by the authors over the years.

-

Add to cart

Taxmann’s flagship publication for Students on Income Tax & GST Law(s), designed to bridge the gap between theory and application. This book is written in simple language, explaining the provision of the law in a step-by-step manner – with the help of suitable illustrations, without resorting to paraphrasing of sections and legal jargons.

-

Add to cart

Taxmann’s Transfer Pricing – A Compendium – 1st Edition February 2022. This book is a collection of incisive & in-depth 75 articles on transfer pricing, authored by 150 recognised experts, covered in 2800 pages.

-

Add to cart

Basic Financial Management is a comprehensive, authentic & well-illustrated student-oriented book, featuring an elementary understanding of concepts, examples & illustrations, solved previous exam question papers, solved problems, summaries, and financial decision making through Excel

-

Read more

The key features of this Combo are as follows: Main Textbook for Corporate & Economic Laws The Present Publication is the thoroughly revised 7th Edition & Updated till 30th April 2021 for CA-Final | New Syllabus, with the following noteworthy features: [Section-wise in a Tabular Format] with a Sub-Heading for each sub-section [Table of Sections along with corresponding Rules] to help …

-

Read more

These books are prepared exclusively for the requirement of the Foundation Level of Chartered Accountancy Examination | Paper 1 to 4, authored by S.K. Agrawal, Manmeet Kaur, Kailash Thakur & Ritu Gupta. This Combo covers the entire revised, new syllabus as per ICAI. CRACKER for Principles & Practice of Accounting CRACKER for Business Laws & …

-

Read more

These books are prepared exclusively for the requirement of the Intermediate Level of Chartered Accountancy Examination Group II | Paper 5 to 8, authored by CA Parveen Sharma, CA Kapileshwar Bhalla, CA Pankaj Garg, CA Vivek Panwar & CA Namit Arora.

-

Read moreThese books are prepared exclusively for the requirement of the Intermediate Level of Chartered Accountancy Examination | Paper 1 on Accounting, authored by D.S. Rawat, Nozer Shroff, Parveen Sharma & Kapileshwar Bhalla.

-

Read more

These books are prepared exclusively for the requirement of the Intermediate Level of Chartered Accountancy Examination | Paper 4 on Taxation, authored by Vinod K. Singhania, Monica Singhania, K.M. Bansal & Sanjay Kumar Bansal.

-

Read more

These books are prepared exclusively for the requirement of the Executive Level of Company Secretary Examination Module II | Paper 5 to 8, authored by N.S. Zad & Mayur Agarwal.

-

Read more

These books are prepared exclusively for the requirement of the Executive Level of Company Secretary Examination | Paper 4 on Tax Laws, authored by N.S. Zad, Pratik Neve, CA (Dr.) K.M. Bansal & CA Anjali Agarwal.

-

Read more

These books are prepared exclusively for the requirement of the Executive Level of Company Secretary Examination | Paper 5 on Corporate & Management Accounting, authored by CS N.S. Zad.

-

Read more

These books are prepared exclusively for the requirement of the Executive Level of Company Secretary Examination | Paper 8 on Financial & Strategic Management, authored by N.S. Zad.

-

Read more

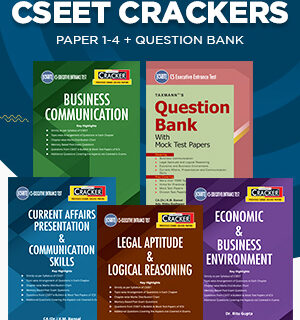

Taxmann’s Combo for CSEET is prepared exclusively for the requirement of the CS Executive Entrance Test | Paper 1 to 4 that includes CRACKERs & Question Bank, authored by CA (Dr.) K.M. Bansal, Adv. Ritika Godhwani, Dr. Ritu Gupta.

-

Read more

These books are prepared exclusively for the requirement of the Professional Level of Company Secretary Examination Module I | Paper 1 to 3, authored by Adv. Ritika Godhwani & CA Pratik Neve.