Category: GST

Showing 21–31 of 31 results

-

Add to cart

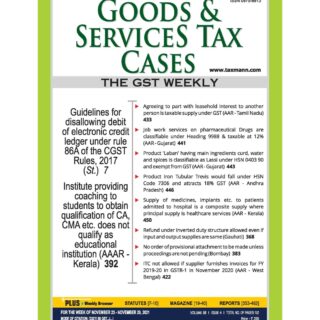

Taxmann’s GST Cases is a weekly in-print Journal that is delivered at your doorstep every week. This Journal is made for professionals, by the professionals, with a focus on the analysis of the latest statutory & judicial changes.

-

Add to cart

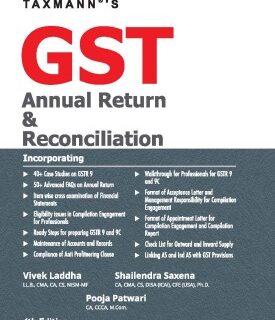

GST Annual Return & Reconciliation covers comprehensive analysis in the form of Case Studies, Advanced FAQs, Step-by-Step Guides etc., on Forms 9, 9A & 9C, along with issues relating to Anti-profiteering & policy mismatch in GST & Accounting Standards. This book will be helpful for GST Professionals engagement in advisory, compliance, and litigation services.

-

Add to cart

Taxmann’s GST E-Way Bill by V.S. Datey – 10th Edition 2022. This book provides complete & updated insight into all provisions relating to GST E-Way Bill, in a simplified manner, with Case Laws. It includes E-Way Bill for transport of goods, generation of E-Way Bill by the portal, road check and verification of documents and conveyances, penalties, tax invoice, delivery challan, GST on goods transport service, etc.

-

Add to cart

Taxmann’s GST How to Meet Your Obligations (Set of 3 Volumes) by S.S. Gupta – 12th Edition February 2022. Taxmann’s bestseller commentary lucidly explains every provision of GST. The discussions are supported by Case Laws & various Examples. It also covers various GST Acts, Rules, Notifications, and Circulars & Clarifications.

-

Add to cart

Taxmann’s GST Input Tax Credit by V.S. Datey – 12th Edition 2022. This book provides complete guidance on Input Tax Credit, Refund of Input Tax Credit & Export issues relating to Input Tax Credit. It also incorporates various issues related to Input Tax Credit such as availment, reversal, refund, etc.

-

Add to cart

Taxmann’s GST Manual with GST Law Guide & Digest of Landmark Rulings (Set of 2 volumes) – 17th Edition February 2022. This book contains a compilation of amended, updated & annotated text of CGST/IGST/UTGST Act & Rules along with Forms (including Action Points), Notifications, Circulars & Clarifications, etc. It also incorporates a 380+ Pages GST Law Guide (Short Commentary) & a Section-wise Digest of Landmark Rulings.

-

Add to cart

Taxmann’s GST on Works Contract & Real Estate Transactions by V.S. Datey – 6th Edition 2022. This book provides complete & updated coverage of the subject matter incorporating issues pertaining to Projects, TDR, Development Rights, FSI, Leasing & Renting along with Numerical Illustrations. Updated till 1st February 2022.

-

Add to cart

Taxmann’s GST Ready Reckoner (The Present Publication is the 17th Edition & updated till 1st February 2022) by V.S. Datey – 17th Edition February 2022. Taxmann’s Ultimate Best-Seller for Indirect Taxes – ‘GST Ready Reckoner’, is a ready referencer for all provisions of the GST Law covering all important topics of GST and relevant Case Laws, Notifications, Circulars, etc. Updated till 1st February 2022.

-

Add to cart

Taxmann’s GST Tariff with GST Rate Reckoner (Set of 2 Volumes) – 16th Edition February 2022. This book provides GST Tariff for Goods and Services with amended tariff schedule as applicable from 1-1-2022. It provides HSN-wise and SAC-wise Tariff of all the Goods and Services along with GST Tariff Notifications (rate of tax & exemptions), Latest Clarifications, Case Laws and Explanatory Notes.