Category: Engineering Contracts

Showing 81–93 of 93 results

-

Add to cart

This book is a comprehensive guide for day-to-day compliance with GST. It helps you understand the following topics related to GST: Background Concepts Execution Challenges Solution(s) It also explains the provisions of the GST law lucidly. This book will be helpful for GST Professionals engaged in managing the client’s day-to-day GST-related affairs, i.e., advisory, compliance and litigation services. The Present Publication …

-

Add to cart

Taxmann GST Refunds By Aditya Singhania Edition 2023 Description This book provides a comprehensive guide to understanding the norms for claiming refunds in GST and handling litigation about GST refunds. The book intends to serve as a guide for all professionals, including CA, CS, CWA, Advocates, GST Practitioners, and their interns/articles involved in advisory, compliance, …

-

Add to cart

This book provides GST Tariff for Goods with HSN Code & Services with Service Code and Explanatory Notes to the Scheme of Classification of Services. The Present Publication is the 19th Edition, amended by the Finance Act 2023 and updated till 1st June 2023. This book is edited by Taxmann’s Editorial Board, with the following noteworthy features: [Taxmann’s …

-

Add to cart

Description This book is a practical guide in understanding the issues raised while replying to the Notice on Input Tax Credit (ITC). It provides a unique step-by-step understanding of the issues on each subject’s particular set of facts. This book is divided into two parts, which are as follows: Division One – Narrates the Input Tax Credit Legislative …

-

Add to cart

Corporate Social Responsibility By Ankur Srivastava Edition 2023 This book is a complete guide/ready reckoner for dealing with corporate social responsibility (CSR) matters. It provides a 360° detailed analysis of the laws and practices related to CSR. This book would be helpful for Company Secretaries, Chartered Accountants, Cost and Work Accountants, Lawyers, other Professionals, and …

-

Add to cart

Taxmann New Law Relating To Reassessment By D.C. Agrawal This book is a comprehensive commentary on the Reassessment provision under the Income-tax Act. It features an exhaustive discussion on the fundamental concepts & issues arising under the law of reassessment combined with essential commentary on statutory provisions & the jurisprudence. It also includes cross-references to other chapters wherever …

-

Add to cart

Mergers Acquisitions & Corporate Restructuring By Rabi Narayan This book provides a complete yet concise treatment of important topics related to the following: Mergers Acquisitions Corporate Restructuring Takeovers This book is highly recommended as a textbook for business management and law students. It provides valuable insights and practical knowledge that will greatly benefit readers. Moreover, …

-

Add to cart

Micro Small & Medium Enterprises (‘MSME’) Ready Reckoner is a comprehensive book on laws governing MSMEs in India. It analyses all the provisions of the MSME Act, 2006 in an easy-to-read FAQ format, along with relevant Circulars & Notifications, illustrations, case studies, etc. This book is a handy referencer for MSMEs and professionals associated with the MSME …

-

Add to cart

Taxmann New Law Relating To Reassessment By D.C. Agrawal This book is a comprehensive commentary on the Reassessment provision under the Income-tax Act. It features an exhaustive discussion on the fundamental concepts & issues arising under the law of reassessment combined with essential commentary on statutory provisions & the jurisprudence. It also includes cross-references to other chapters wherever …

-

Add to cart

Taxmann New Law Relating to Taxation of Start ups & Investors Taxmann New Law Relating to Taxation of Start ups & Investors This is a handy book for the taxation of start-ups & investors, including, but not limited to, the following: Tax Holiday u/s 80-IAC of the Income-tax Act 1961 Angel Tax Exemption All topics related to …

-

Add to cart

CA Final Direct tax Question Book By Vinod Gupta Description This compilation of questions of last 27 years of CA Final Exams is to let you understand the pattern of questions asked from various parts of the syllabus. So, you can solve questions of last 56 attempts. This Question Book will help you in practicing the …

-

Add to cart

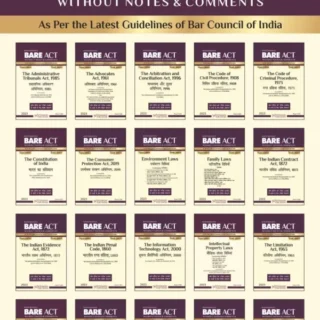

All India Bar Examination Set of 20 Books Edition 2023 All India Bar Examination Set of 20 Books Edition 2023 Set of 20 Bare Acts for All India Bar Examination (2023) [Without Notes] This is a Special Edition for the Students who are appearing in the AIBE conducted by The Bar Council of India. The Bar Council of India (BCI) has Notified that for AIBE (All …

-